When you’re managing multiple construction projects across departments, insurance compliance can either be a pain point or a competitive advantage. For Kitchell, a national builder with decades of experience, staying compliant while scaling fast was critical. But their existing processes weren’t cutting it. Review times were slow. Documents were getting lost in inboxes. Tracking was scattered across systems.

That’s when the team turned to Billy.

What happened next? Kitchell didn’t just meet their goals. They crushed them.

The Challenge: Complex Projects, Manual Insurance Reviews, and Slow Turnarounds

Kitchell started with four active construction projects, each with its own set of insurance requirements, vendors, and timelines. Compliance management was manual and time-consuming. It could take up to a week just to review a single certificate of insurance. For a growing construction firm, that kind of delay isn’t just inconvenient. It’s a risk.

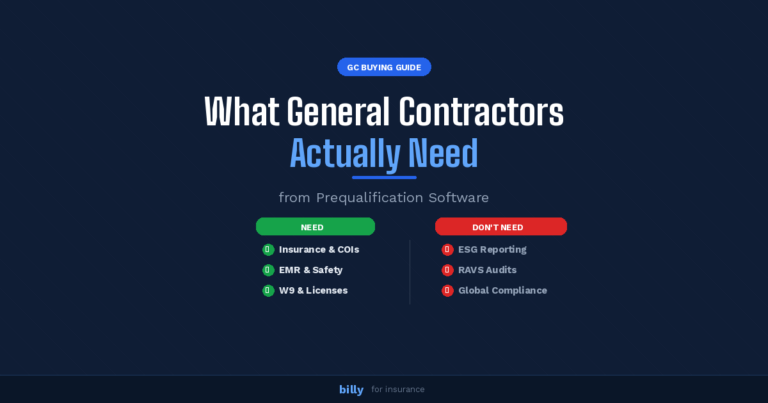

Erica, one of Kitchell’s compliance leaders, needed a faster, smarter way to:

- Review and approve COIs instantly, especially for urgent project needs

- Centralize insurance tracking across departments

- Customize insurance requirements by project and vendor

- Reduce the back-and-forth with vendors and cut down on manual review

That’s a tall order for any internal team. But with Billy, Kitchell didn’t have to go it alone.

The Solution: Billy’s Automation, CRIS Review Team, and Procore Integration

Kitchell partnered with Billy and began rolling out the platform across active projects.

Faster Turnaround Times

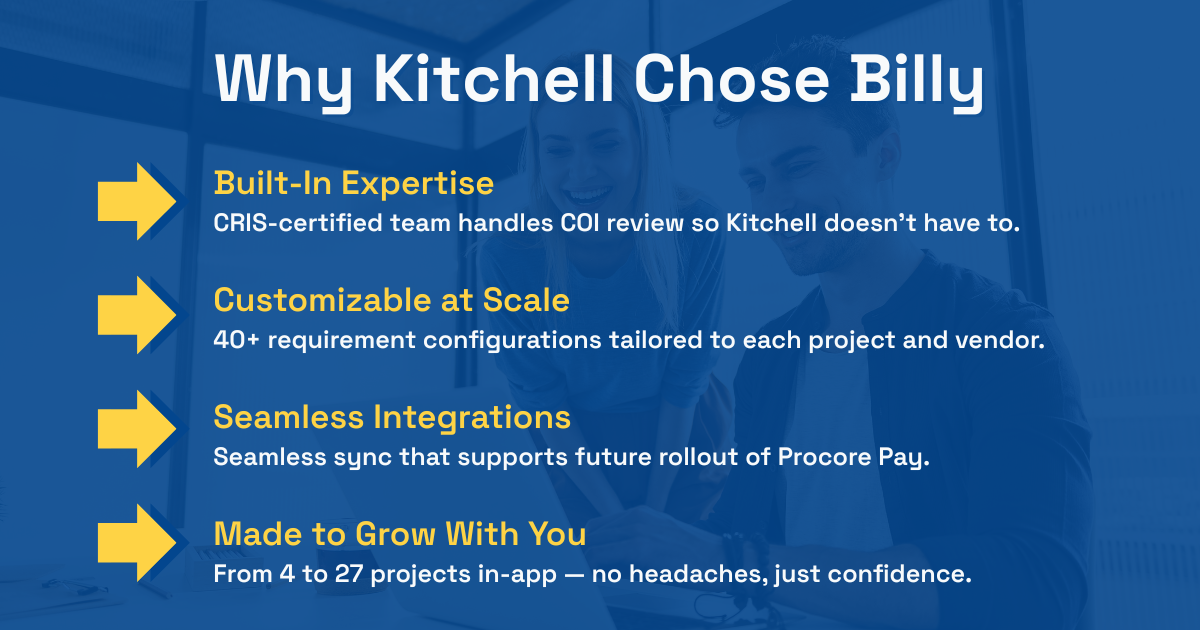

The number one goal? Speed. Kitchell wanted to shrink that one-week review time down to 24–48 hours. With Billy’s CRIS-certified review team managing insurance documents, Kitchell immediately saw the difference. Urgent requests no longer sat idle. Reviews happened faster. And projects kept moving.

Centralized, Organized Insurance Tracking

Before Billy, insurance tracking lived in silos. Now, 14 Kitchell team members across two departments use Billy within a centralized dashboard. Everyone has visibility. Everyone stays on the same page. This level of organization created confidence to bring more users, and more projects, into the system.

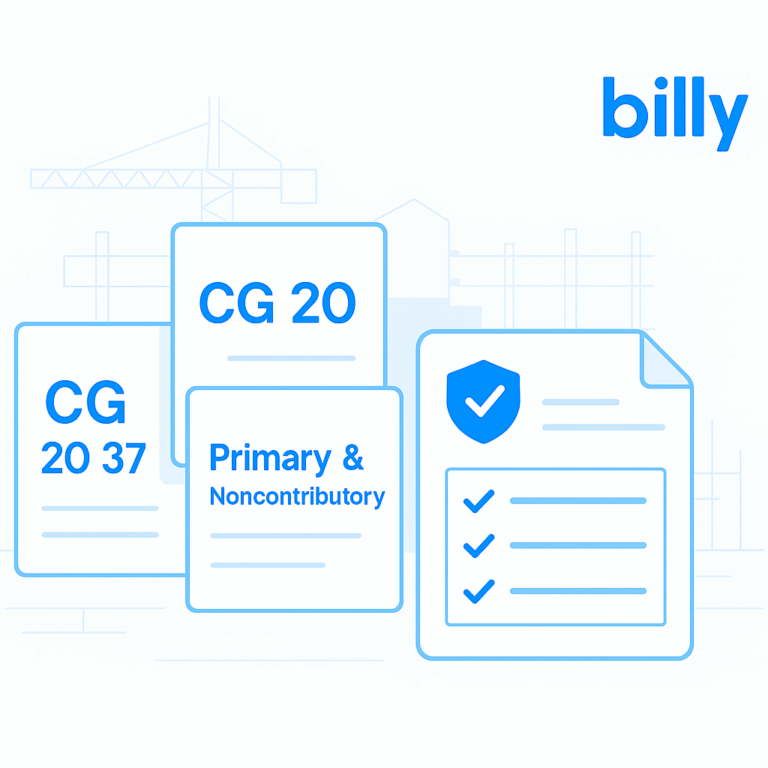

Custom Requirements at Scale

Kitchell’s insurance requirements weren’t one-size-fits-all. With Billy, they didn’t have to be. The team built 40+ requirement group configurations, tailored to specific projects, vendors, and contract types. That kind of flexibility allowed Kitchell to stay compliant at scale, without sacrificing the details.

Less Manual Effort

Vendor follow-ups. Status emails. Sorting through attachments. All of it used to eat up time. Billy’s automation and review team offloaded the heavy lifting so Kitchell’s internal team could focus on higher-value work. Communication with vendors is clear and documented. Nothing gets missed.

The Results: 6x Growth in Project Volume and Full Confidence in Scaling

Seven months after implementation, Kitchell grew from managing 4 active projects to 27, all tracked and supported within Billy. That’s 6x the project volume, with centralized access for all stakeholders and a 79% account compliance rate across the board.

This success gave Kitchell the confidence to expand their use of Billy into another department. And it’s just the beginning.

Integration-Driven Efficiency: Procore + Oracle JD Edwards

Billy’s deep integration with Procore has become a foundational part of Kitchell’s tech stack, streamlining compliance and document flow across platforms. But where Billy really shines is in its ability to solve real-world challenges through custom solutions.

To eliminate double entry and accelerate payment cycles, Billy’s team built a tailored integration connecting compliance data between Billy, Procore, and Oracle JD Edwards. With custom rules designed around Kitchell’s unique workflows, data now flows automatically — enabling faster, more accurate processing across departments.

This integration not only removed administrative friction but also set Kitchell up for future innovations, like rolling out Procore Pay. With Billy managing compliance behind the scenes, Kitchell can confidently adopt more tools without adding complexity, proving that the right technology partner doesn’t just support growth, it accelerates it.

The Billy Difference: Real-Time Support and a True Partnership

Technology is only part of the story. What keeps Kitchell coming back is the people behind the platform.

Whenever a challenge comes up, Erica knows she can reach out to Billy’s support and partner success team. And they deliver, quickly. Whether it’s a vendor issue or a configuration tweak, the Billy team responds fast and resolves problems without friction.

That kind of partnership makes a difference. Kitchell isn’t just using a platform. They’re building a long-term strategy around it.

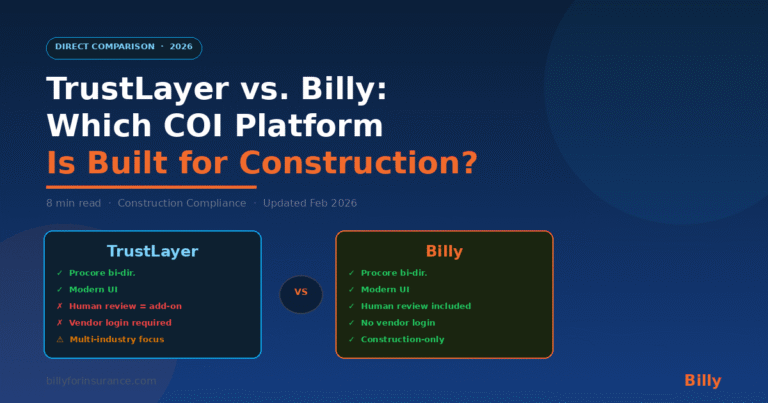

Why It Works

Billy doesn’t just offer insurance tracking software. It delivers construction-specific compliance solutions that are flexible, fast, and backed by real people who care.

For Kitchell, this meant:

- Removing bottlenecks in project startup and vendor onboarding

- Getting real-time visibility into compliance across projects

- Future-proofing their operations with an integrated tech stack

- Feeling supported at every step — from implementation to expansion

Ready to Scale Like Kitchell?

If your team is spending hours chasing COIs, reviewing documents, or trying to wrangle compliance across multiple systems, it’s time for a better way.

Billy makes insurance compliance simple. Our CRIS-certified team does the heavy lifting so you don’t have to. And our platform grows with you, whether you’re managing 4 projects or 400.

Start your free trial today to see how Billy can work for your construction team.

Frequently Asked Questions

Yes. Kitchell uses over 40 custom requirement group configurations within Billy, allowing them to tailor insurance requirements by project, vendor, or contract type. This flexibility helps large contractors stay compliant while managing diverse insurance needs at scale.

Billy integrates directly with Procore to sync project data and automate insurance tracking workflows.

Billy is built to scale with your business. With features like centralized access, customizable compliance settings, and automation tools, Billy can support dozens (or even hundreds) of projects without adding operational overhead.