Managing Certificates of Insurance (COIs) is critical for compliance in the construction industry. CRIS-certified experts are professionals with specialized knowledge in construction risk management and insurance. They possess a deep understanding of the nuances involved in construction contracts, insurance requirements, and regulatory compliance.

Their expertise extends beyond traditional insurance practices, enabling them to provide a comprehensive compliance review tailored specifically for the construction industry. With years of experience, CRIS experts are adept at identifying the subtle intricacies of construction insurance, which are often overlooked by those less familiar with the field.

Strategic Advisory Services

CRIS experts’ role is not limited to compliance checks, but also involves strategic advisory services. By working closely with construction firms, they can identify potential areas of risk before they become issues.

This proactive stance is invaluable in an industry where the stakes are high, and regulatory landscapes are continually evolving. By engaging with CRIS experts for COI review (like those at Billy), construction companies gain a strategic partner who can guide them through complex insurance landscapes, ensuring that all aspects of a project are adequately covered.

Specialized Knowledge in Regulatory Compliance

CRIS experts are well-versed in the latest industry standards and regulations. They stay updated on changes in legislation and insurance requirements, ensuring that your construction projects remain compliant. By leveraging their expertise, you can avoid costly penalties and legal disputes that may arise from non-compliance.

Their deep understanding of local, state, and federal regulations allows them to tailor compliance review strategies to fit the specific needs of each project. Moreover, CRIS experts have extensive networks within the industry, which provide them with insights into upcoming regulatory changes. This foresight enables construction firms to prepare well in advance, ensuring that they are always a step ahead.

The ability to translate complex regulatory language into actionable strategies means that your team can focus on construction while they handle compliance intricacies. This assurance is invaluable, particularly in a field where non-compliance can result in significant financial and reputational damage.

Comprehensive Risk Assessment

One of the key benefits of engaging CRIS experts is their ability to conduct thorough risk assessments. They meticulously analyze insurance documents to identify potential coverage gaps and liabilities. This proactive approach helps mitigate risks and ensures that your construction projects are adequately protected.

By identifying risks early, CRIS experts can devise strategies to either eliminate or minimize these risks, safeguarding the project’s success. Their assessments not only protect against financial losses but also contribute to maintaining a firm’s reputation and client trust.

Streamlining the COI Compliance Review Process

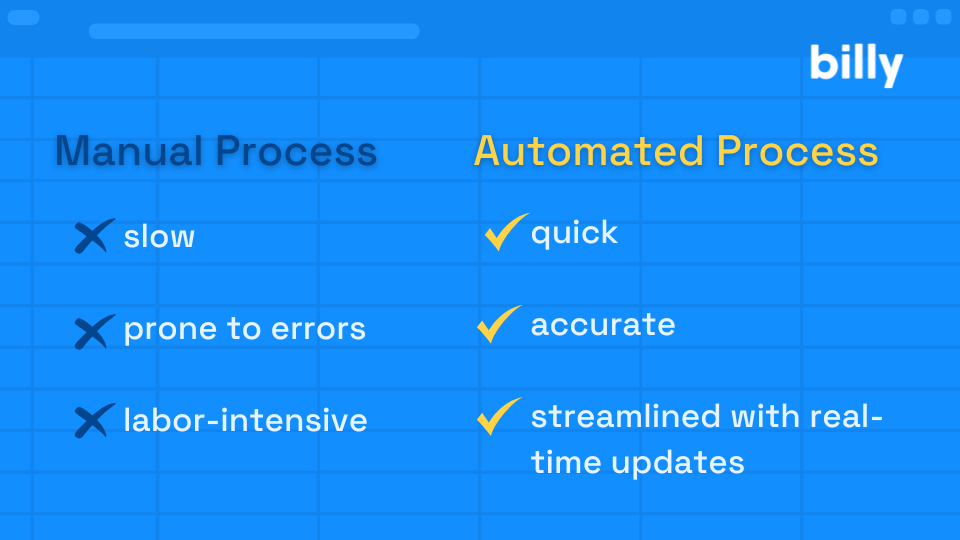

The COI review process can be daunting, especially for large construction projects with hundreds of subcontractors and vendors. CRIS experts simplify this process by implementing efficient review systems, often utilizing digital technology and automation. Their approach ensures that COI management is not only thorough but also streamlined to prevent bottlenecks that could delay project timelines.

CRIS experts understand the importance of timely COI reviews in maintaining project momentum. By employing systematic processes and automated technology, they can quickly and accurately verify insurance details. This efficiency is crucial in large-scale projects where even minor delays can escalate into significant setbacks.

Automation and Digital Technology

By integrating digital technology into the COI review process, CRIS experts enhance efficiency and accuracy. Automated systems enable quick verification of insurance coverage, reducing the manual workload and minimizing human error. This technology-driven approach ensures that COIs are up-to-date and compliant with industry standards.

Automation also allows for real-time updates and alerts, ensuring that any lapses in coverage are immediately addressed. Incorporating digital platforms also facilitates better communication between all stakeholders involved.

Efficient Management of Certificates

CRIS experts help to streamline the management of COIs by organizing them in a centralized digital repository. This allows for easy access and retrieval, facilitating seamless communication between project managers, compliance officers, and insurance providers. With all documents readily available, you can swiftly address any compliance issues that may arise.

Providing Practical Solutions for Compliance Challenges

CRIS experts bring practical solutions to the table, addressing common compliance challenges faced by construction professionals. Their ability to apply theoretical knowledge in a practical context makes them invaluable assets in ensuring construction compliance.

They bridge the gap between complex regulatory frameworks and everyday construction practices, offering solutions that are both innovative and grounded in industry realities. Their approach to problem-solving is collaborative, involving key stakeholders in the development of compliance strategies. By fostering a culture of compliance, CRIS experts help instill a sense of responsibility and awareness among project teams.

Tailored Compliance Review Strategies

Every construction project is unique, with its own set of compliance requirements. CRIS experts work closely with project managers and compliance officers to develop tailored strategies that address specific compliance challenges.

This personalized approach ensures that your projects meet all regulatory standards. By taking the time to understand the nuances of each project, CRIS experts can devise strategies that are both effective and sustainable. Tailored compliance strategies also involve continuous feedback loops, allowing for adjustments as projects evolve.

Continuous Monitoring and Support

Compliance is not a one-time task; it requires continuous monitoring and support. CRIS experts provide ongoing assistance, keeping you informed of any changes in regulations or insurance requirements. Their proactive monitoring ensures that your projects remain compliant throughout their lifecycle. This ongoing support is vital in maintaining compliance and addressing any issues promptly as they arise.

Elevate Your Construction Projects with Billy’s CRIS Expertise

Billy’s managed services plan includes access to a team of CRIS-certified experts, allowing construction firms to access this specialized knowledge without the need for extensive in-house expertise.

These experts help firms navigate the regulatory maze, ensuring compliance with local, state, and federal standards. Their understanding of industry nuances allows them to tailor compliance strategies for each project, preventing legal disputes and penalties that could arise from non-compliance. Construction professionals who embrace CRIS expertise position themselves for long-term success.

Frequently Asked Questions

How do you request a COI for construction?

To request a Certificate of Insurance (COI) for a construction project, contact the contractor or vendor you plan to hire and ask them to provide a COI directly from their insurance provider. Specify the required coverage limits and whether you need to be listed as an additional insured. Once received, review the COI to ensure it meets your project’s requirements before proceeding. Let Billy automate this entire process for you—making COI tracking and verification seamless and hassle-free!

When should you request a Certificate of Insurance?

Request a COI well in advance of project work to ensure all parties are covered. Ideally, it should be requested during the contract phase, before work begins, to confirm coverage and compliance.

Who signs a COI?

A COI is typically signed by the insurance provider or an authorized representative of the insurance company issuing the policy. This signature confirms that the insurance coverage meets the required standards for the project.