The construction industry is no stranger to paperwork. Every project relies on certificates of insurance, endorsements, and other compliance documents to protect owners, contractors, and subcontractors from unnecessary risk. But for project managers and coordinators, reviewing these documents manually takes valuable time and often slows down operations.

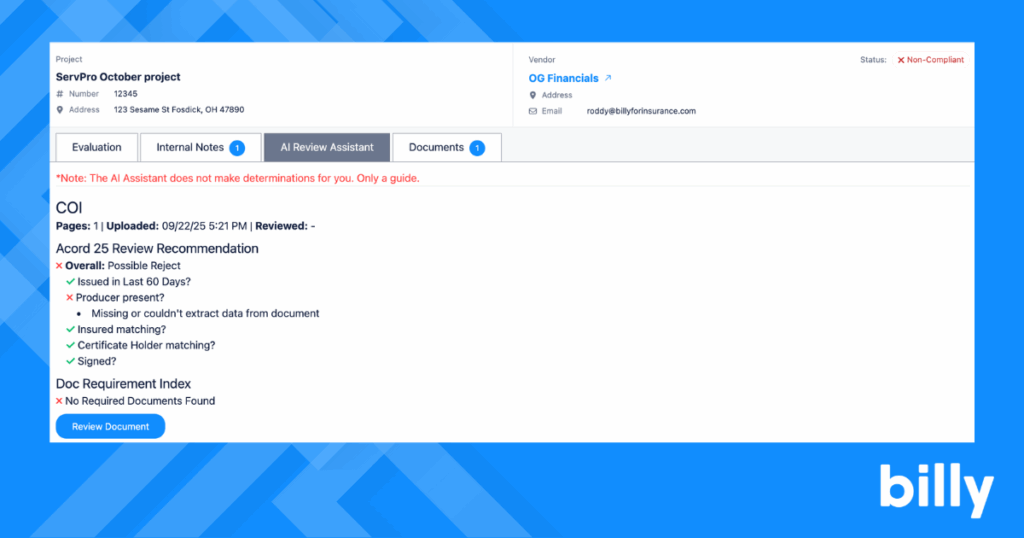

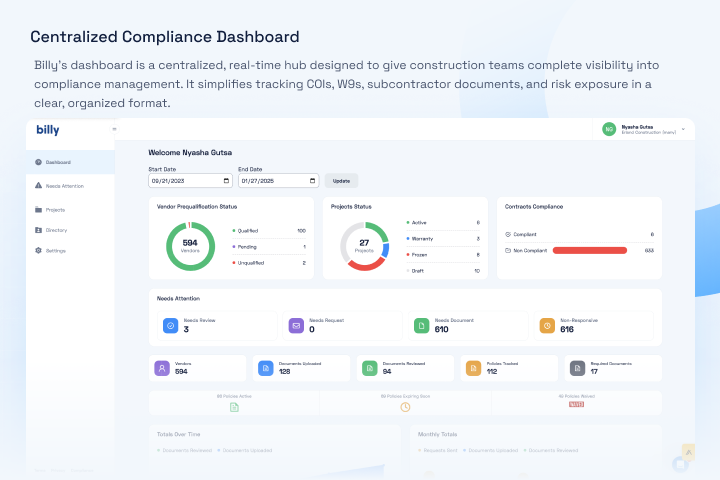

Billy is changing that. With the launch of the AI Review Assistant, construction teams can now automate one of the most time-consuming compliance tasks: reviewing subcontractor insurance documents. The AI Review Assistant not only identifies compliance gaps but also integrates seamlessly with project management and accounting systems, making compliance both faster and smarter.

The Problem: Manual Compliance Drains Time and Creates Risk

On any given project, dozens or even hundreds of subcontractors submit COIs and endorsements like CG 20 10, CG 20 37, or Primary & Non-Contributory forms. Traditionally, a project coordinator must review each submission line by line, often spending nearly ten minutes per document. Multiply that across hundreds of submissions, and compliance quickly becomes a bottleneck.

Even with careful review, human error is inevitable. Missing endorsements or outdated coverage might slip through, leaving the general contractor exposed to liability. In industries where margins are tight, a single compliance miss can have costly consequences.

The AI Review Assistant was built to solve these challenges by reducing manual work, minimizing risk, and giving construction teams time back to focus on what matters most: delivering projects safely and profitably.

Faster Reviews, Smarter Decisions

The AI Review Assistant uses advanced artificial intelligence models to read and understand insurance documents, flagging missing coverage, invalid endorsements, or expired policies. What once took a project coordinator nine minutes now takes less than one.

“What once took a project coordinator nine minutes now takes less than a minute,” said Eric Weatherwax from BBL Construction. “The AI helps review thousands of subcontractor insurance documents submitted through Billy and syncs them automatically to Procore and Sage 300”

By cutting review time down dramatically, construction teams are able to onboard subcontractors faster, reduce delays, and keep projects moving on schedule.

Key Benefits of the AI Review Assistant

1. Risk Mitigation and Reduced Exposure

The AI Review Assistant automatically identifies non-compliant insurance coverages and missing endorsements. This means subcontractors who fail to meet project-specific requirements are flagged immediately, reducing liability before crews ever step on site.

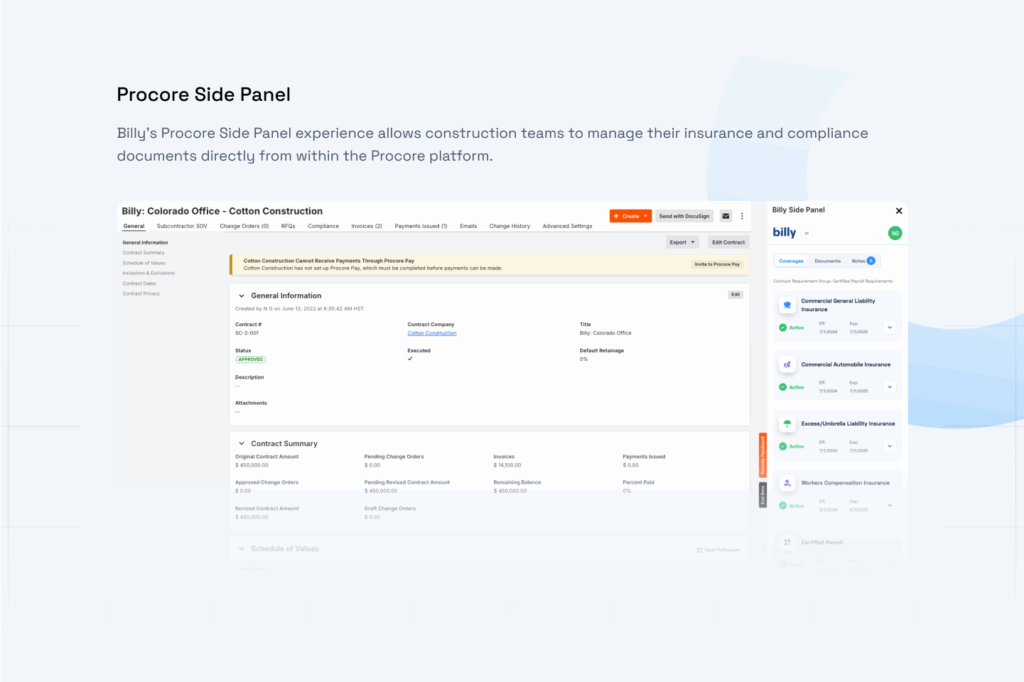

2. Seamless Integration Across Platforms

Compliance doesn’t happen in isolation. That’s why Billy designed the AI Review Assistant to integrate directly with systems construction teams already use, including Procore, Autodesk, DocuSign, and accounting platforms like Sage 300, Viewpoint Vista, and Oracle JD Edwards. This ensures compliance data flows smoothly across project, contract, and finance systems.

3. Operational Efficiency at Every Level

Instead of waiting days for approvals, teams can make real-time decisions. Field teams can allow subcontractor crews on site only when compliance is verified in Billy, while office teams can process payments with confidence knowing compliance has already been checked.

4. Smarter Workflows Through Real-Time Flagging

The system flags discrepancies instantly. Whether it’s an expired policy or a missing endorsement, issues are caught before they slow down projects. This reduces back-and-forth communication and helps everyone stay on the same page.

Built With Construction Experts

Unlike generic AI tools, the Review Assistant was built with direct input from construction partners managing complex contract requirements.

“We built this with construction partners managing complex contract requirements,” said Brett Wise, Principal Software Engineer at Billy. “The system is modular, so new features can be added quickly. Teams can now check the contractual status of a subcontractor much faster.”

Billy’s AI models are trained on a large dataset of real insurance documents, which increases both accuracy and reliability. This industry-specific approach ensures the AI understands the nuances of insurance compliance in construction, something off-the-shelf OCR tools often miss.

Smarter Insurance Document Review

At its core, the AI Review Assistant is designed to answer three simple but critical questions:

- Does this subcontractor’s insurance meet project requirements?

- Are the necessary endorsements present and valid?

- Is coverage current and compliant?

The AI reads and understands insurance documents in natural language, not just as scanned images. This allows it to process endorsements like CG 20 10 or Primary & Non-Contributory more accurately than traditional tools. By reducing manual intervention, construction teams lower the risk of error, accelerate response times, and gain confidence that every subcontractor on site is properly insured.

How Billy’s AI Architecture Works

“We designed a multi-layered AI architecture that lets us plug in the latest models as they evolve,” said Nyasha Gutsa, Billy’s CEO. “This gives our partners faster, more precise insights—and helps them make confident decisions.”

This modular AI design means Billy can adapt quickly as artificial intelligence technology advances. For users, that translates into long-term reliability and continuous improvement, ensuring compliance automation stays ahead of industry challenges.

Core Features of the AI Review Assistant

- Breakthrough Data Extraction: Reads documents that traditional OCR tools cannot interpret.

- Natural Language Processing (NLP): Understands unstructured insurance text for more accurate insights.

- API Integration: Syncs directly with project management and accounting systems for real-time updates.

These core capabilities create a compliance solution that goes beyond simple automation. Instead, they deliver actionable insights that help contractors reduce risk, improve operational efficiency, and protect project margins.

Why This Innovation Matters for Construction

For many construction companies, compliance has always been a headache. The industry’s heavy reliance on subcontractors makes managing insurance a constant challenge. Without automation, teams often resort to spreadsheets, emails, and long manual review cycles.

The AI Review Assistant eliminates these inefficiencies. By combining speed with accuracy, Billy helps construction companies:

- Stay audit-ready year-round

- Protect projects from uninsured subcontractors

- Accelerate subcontractor onboarding

- Reduce disputes and payment delays

- Safeguard profitability by avoiding compliance-related setbacks

Compliance doesn’t have to be a burden. With AI-driven tools, it can become a strategic advantage.

Built for the Future

Billy is committed to ongoing innovation. With AI now at the core of its platform, the company is building tools that will continue to evolve, helping construction teams eliminate manual work, lower risk, and improve compliance visibility across every project.

The AI Review Assistant is only the beginning. As Billy expands its AI-powered solutions, users can expect even more ways to streamline compliance and stay ahead of industry demands.

Experience Billy’s AI Review Assistant

The AI Review Assistant is already helping contractors, property managers, and insurers save time and reduce risk on every project. By automating compliance review, your team can work smarter, move faster, and protect margins.

Schedule a demo with Billy and start your 60-day free trial to see the AI Review Assistant in action and explore how it can transform compliance for your business.

Frequently Asked Questions

The AI has been trained on a large dataset of real insurance documents, making it highly accurate in detecting missing endorsements, expired coverage, or non-compliant policies. It also improves continuously as more documents are processed.

Not at all! The AI is designed to support construction teams by automating the most repetitive tasks. Project coordinators and risk managers still make the final decisions, but they can do so with far greater speed and confidence.

Yes! The modular architecture allows Billy to adapt to different contract requirements and endorsement types, ensuring flexibility across a wide range of construction projects.