Managing certificates of insurance (COIs) in construction can be complex due to the numerous regulatory standards and legal details involved. Oversight can potentially cost you thousands and land you in legal trouble.

In the thick of it all, you may find yourself missing vital steps for managing certificates of insurance in construction.

This guide will help you set up a system for managing COIs in construction to keep you compliant and able to focus on other areas of your business.

Understanding COIs in Construction

In order to efficiently manage COIs, you need an in-depth understanding of the importance of insurance certificates in the construction sector.

COIs serve only as proof of insurance coverage at a point in time, outlining the specific policies, limits additional insureds held by the certificate holder who can be a General Contractor, Subcontractor, and other stakeholders involved in construction projects. These certificates are vital in mitigating risk and ensuring compliance with contractual agreements and legal requirements.

Construction projects are dynamic and involve various parties collaborating and interacting. COIs provide clarity and transparency regarding insurance coverage amongst all of these stakeholders. They help project managers assess potential risks associated with subcontractors or vendors, ensuring that all parties involved have adequate insurance protection against liabilities such as property damage, bodily injury, or worker’s compensation claims.

An in-depth understanding of COIs allows for efficient risk management strategies. By carefully examining the details outlined in these certificates, project managers can identify gaps in insurance coverage and take necessary steps to address them, thereby reducing the likelihood of costly disputes or financial losses.

COIs are essential for maintaining project integrity, protecting assets, and fostering smooth collaboration among stakeholders. With proper management of COIs, construction projects can proceed with confidence, knowing that adequate insurance coverage is in place to safeguard against unforeseen circumstances and potential liabilities.

Creating a Process for Managing COIs

Having a structured process for managing Certificates of Insurance is crucial in the construction industry. Without a standardized, well-defined approach to COI management, confusion may arise regarding insurance coverage, potentially leading to disputes, delays, or financial liabilities.

Having a clear process in place facilitates compliance with contractual requirements and regulatory standards, promoting trust and accountability among project participants. Ultimately, an effective COI management process contributes to smoother project execution, protects against potential losses, and strengthens the overall integrity of construction projects.

Let’s dive into a 5-step process to effectively and efficiently manage Certificates of Insurance for construction projects.

Step 1: Establish Clear Insurance Requirements

Establishing clear insurance requirements is the foundational step in managing COIs for construction projects. This involves defining the types and levels of insurance coverage necessary for all parties involved in the project.

Here’s how to accomplish this:

- Conduct a thorough review of project specifications, contracts, and applicable regulations to determine insurance needs.

- Identify specific types of insurance coverage required, such as general liability, workers’ compensation, professional liability, and umbrella/excess liability.

- Define the minimum limits of coverage for each type of insurance based on project size, scope, and risk factors.

- Clarify any additional insured endorsements or waiver of subrogation requirements that may be necessary.

- Communicate insurance requirements clearly to all project stakeholders, including contractors, subcontractors, vendors, and suppliers.

By establishing clear insurance requirements upfront, project managers can ensure that all parties understand their insurance obligations and can procure the necessary coverage in a timely manner. This lays the groundwork for effective COI management throughout the duration of the construction project, minimizing potential risks and liabilities.

Step 2: Collect and Review Certificates

Once clear insurance requirements are established, the next step is to collect and review Certificates of Insurance from all project stakeholders. This process ensures that the required insurance coverage is in place and meets the specified criteria.

Here’s how to effectively collect and review COIs:

- Develop a systematic approach for collecting COIs from contractors, subcontractors, vendors, and suppliers, ensuring that all parties are aware of submission deadlines and documentation requirements.

- Ditch the spreadsheets and implement a centralized system or software to streamline the collection and storage of COIs, facilitating easy access and retrieval when needed.

- Verify that each COI received contains accurate and up-to-date information, including the names of insured parties, policy numbers, coverage dates, and policy limits.

- Cross-reference the details provided in COIs with the established insurance requirements to ensure compliance.

- Pay close attention to any additional insured endorsements, waivers of subrogation, or specific insurance provisions required by contracts or project specifications.

- Follow up promptly with stakeholders to address any discrepancies or missing information in COIs, requesting revised certificates as necessary.

By diligently collecting and reviewing COIs, project managers can confirm that all parties involved in the construction project have adequate insurance coverage to protect against potential risks and liabilities.

This anticipatory approach helps mitigate insurance-related issues and enhances overall project management efficiency. Additionally, thorough documentation of COIs provides a valuable record of insurance compliance throughout the project lifecycle, aiding in risk assessment, auditing, and dispute resolution if needed.

Step 3: Organizing Certificates of Insurance

Organizing Certificates of Insurance is crucial for maintaining clarity and accessibility throughout the construction project. This step involves structuring the collected COIs in a systematic manner to facilitate efficient management and retrieval.

Here’s how to effectively organize COIs:

- Utilize a comprehensive filing system or digital database to categorize and store COIs according to project stakeholders, insurance types, or policy periods.

- Create standardized naming conventions or labeling protocols for COI files to ensure consistency and ease of identification.

- Implement a tracking mechanism to monitor the expiration dates of insurance policies and schedule timely renewals or updates.

- Maintain separate folders or sections within the COI repository for primary documents, endorsements, waivers of subrogation, and other related correspondence.

- Consider using cloud-based storage solutions or document management software to centralize COI organization and facilitate remote access for authorized personnel.

- Audit and update the COI database regularly to reflect any changes or additions in insurance coverage throughout the project lifecycle.

By organizing COIs in a structured manner, project managers can quickly locate and reference relevant insurance documents as needed, reducing the risk of oversight or confusion. This systematic approach also promotes compliance with contractual requirements and regulatory standards, enhancing overall project transparency and accountability.

Step 4: Monitoring Compliance and Expiration Dates

Monitoring compliance and expiration dates of Certificates of Insurance is essential for ensuring continuous coverage throughout the construction project. This step involves implementing a future-focused system to track insurance compliance and anticipate upcoming policy expirations.

Here’s how to effectively monitor compliance and expiration dates:

- Establish a schedule for regular reviews of COIs to verify ongoing compliance with insurance requirements and contractual obligations.

- Utilize reminder notifications or calendar alerts to notify relevant stakeholders of impending COI expirations well in advance.

- Maintain open communication channels with insurance providers and project stakeholders to address any issues or concerns regarding insurance coverage or policy renewals.

- Develop contingency plans or alternative strategies to mitigate potential gaps in coverage in the event of expired or inadequate insurance policies.

- Document all communications and actions taken regarding COI compliance monitoring, including any follow-up requests for updated or revised certificates.

- Conduct periodic audits or assessments of insurance compliance processes to identify areas for improvement and ensure consistency and accuracy in monitoring efforts.

By diligently monitoring compliance and expiration dates of COIs, project managers can proactively address any lapses in insurance coverage and minimize the risk of disruptions or liabilities during the construction project. This preventive approach promotes project continuity and risk mitigation while maintaining transparency and accountability among all stakeholders involved.

Step 5: Address Issues Promptly

Addressing issues promptly is the final crucial step in effectively managing Certificates of Insurance within construction projects. Timely resolution of any discrepancies, gaps, or concerns related to insurance coverage helps mitigate potential risks and ensures project continuity.

Here’s how to efficiently address issues as they arise:

- Implement a designated point of contact or responsible party within the project team to oversee construction COI management and address any insurance-related issues promptly.

- Establish clear protocols and escalation procedures for reporting and resolving COI discrepancies or deficiencies, outlining responsibilities and timelines for resolution.

- Communicate openly and transparently with all project stakeholders regarding any identified issues or concerns with COIs, providing clear instructions and guidance on necessary corrective actions.

- Work closely with insurance providers and legal counsel to assess the impact of COI issues on project risk exposure and develop appropriate mitigation strategies.

- Document all communications, actions taken, and resolutions achieved in addressing COI issues, maintaining a comprehensive record for future reference and audit purposes.

- Conduct post-mortem reviews or lessons learned sessions at the conclusion of the project to identify any recurring COI issues or areas for process improvement.

By addressing COI issues promptly, project managers can minimize potential disruptions, conflicts, and liabilities associated with inadequate insurance coverage. Additionally, timely resolution of COI issues contributes to overall project success by ensuring compliance with contractual requirements and regulatory standards.

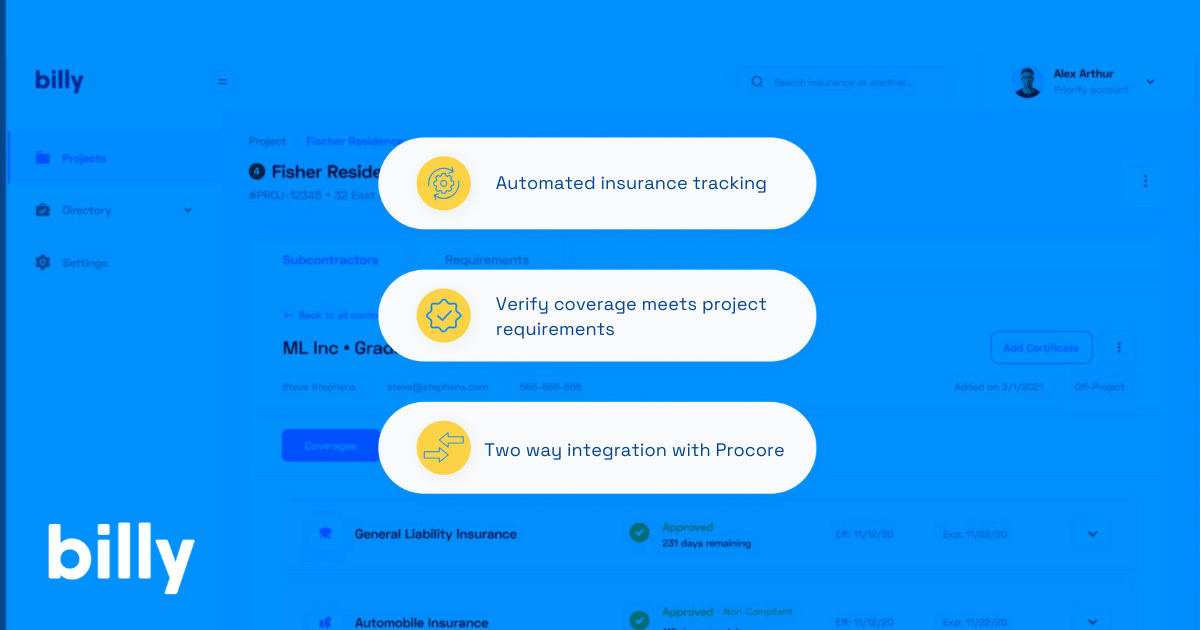

How to Automate the Construction COI Management Process

Modern construction projects don’t shy away from embracing technology, and the management of certificates of insurance should be no exception. Technology can play a significant role in streamlining your insurance certificate management process, making it easier to track, evaluate, and update your insurance certificates without the hassle of manual paperwork.

Automating the critical processes of tracking, storing, and renewing these certificates can help eliminate human error, save time, and effectively maintain compliance.

Streamline your COI management process with the Billy platform by:

- Collecting compliance documents in one place (COIs, W9s, Business Licenses, etc.)

- Quickly identifying compliant vendors and subcontractors

- Automating alerts to vendors and subcontractors when their insurance is expiring

- Syncing compliance information with the Procore project management system

With Billy, you can save time and money, simplify your COI management

process, and protect your business.

Customer Story: How Broadway Construction Group Improved Insurance and Compliance Management with Billy

Don’t just take it from us. Broadway Construction Group is a construction management and general contracting firm specializing in complex residential, hospitality, commercial, and retail projects in the New York Metropolitan Area. David Rivera, Director of Operations, supervises insurance and compliance at Broadway Construction Group.

With Billy, David and his team have been able to:

- Save up to 80% in time through automation processes and integrations

- Reduce manual errors in insurance and compliance documentation

- Avoid the disruptive impact of claims with compliance he can trust

Overall, Billy has been a valuable asset for Broadway Construction Group, helping them improve their insurance management process and mitigate risk.

Schedule a demo with one of our team members to learn how the Billy platform can transform your COI management.

Frequently Asked Questions

Why is Managing Certificates of Insurance Important in Construction?

Poor management of COIs can steer your construction projects off course. If not well-managed, these certificates could result in unnecessary exposure of your business to risks, severe financial burdens, or legal complications. By correctly managing your COIs, your business can evade hefty fines or legal battles that sprout from failure to comply with insurance requirements. Moreover, effectively overseeing your COIs can empower you to maintain operational continuity in the face of unexpected adversities.

What technology is available to help with managing construction COIs?

Several technologies are available to assist in managing construction Certificates of Insurance. These include specialized COI management software, which streamlines the collection, organization, and tracking of insurance documents. The best solution integrates these features with project management vendors such as Procore.

What are the steps in a COI management plan?

The steps in a COI management plan typically include establishing clear insurance requirements, collecting and reviewing certificates, organizing documents systematically, monitoring compliance and expiration dates, and addressing any issues promptly. These steps ensure effective management of Certificates of Insurance throughout construction projects.