General Contractors are responsible for ensuring third-party vendors maintain the necessary insurance coverage by requesting a certificate of insurance and the appropriate endorsements.

Often this process takes a lot of time and effort to do correctly. It’s not unusual for project teams to spend time communicating the requirements to a vendor, who in turn has to request the insurance documents from their insurance broker(s), and your team has to review the insurance documents, then transfer that information into different systems for payments, reporting and project management.

Is your team keeping up with compliance?

A vendor’s insurance coverage can change in the middle of a project without your project team knowing about it. There can be a gap in coverage in what you think your compliance percentage is versus what it is. Without the proper process, compliance items may be slipping through the cracks without your project team realizing it, and it can end up costing your company millions of dollars in insurance claims.

There are three areas project teams should incorporate in their risk management:

- Request project-specific coverage annually: It is important to pre-qualify insurance coverage and the vendor’s financial health at the beginning of the working relationship. When a contract is awarded to a vendor on a project, your team should request project-specific insurance that names the owner, lender, and general contractor as the additional insureds to prevent risk transfer. When a vendor starts on a project, the contract may ask them to increase their insurance coverage limits to comply with the contract. While they give documentation during the first year of a project, they may decrease their coverage over time, even against their contractual obligations to save money, exposing your team to risk transfer.

- Compliance during completed operations: The contract may require certain coverage if operations are ongoing after construction. Some owner contracts state that insurance coverage for vendors conducting post-construction operations should be maintained for 5-10 years. A system like Billy helps your team determine if a vendor has removed, reduced, or canceled coverage during continued operations.

- Streamlining communication with multiple insurance agents: If a vendor has more than one insurance agent for various types of coverage, there is more communication required to coordinate the exchange of certificates of insurance, chase missing and expired documents.It’s helpful to have a system that communicates to project teams that work in systems like Procore or Autodesk and for the accounting department to process payments in systems like Sage 300 and Viewpoint Vista.

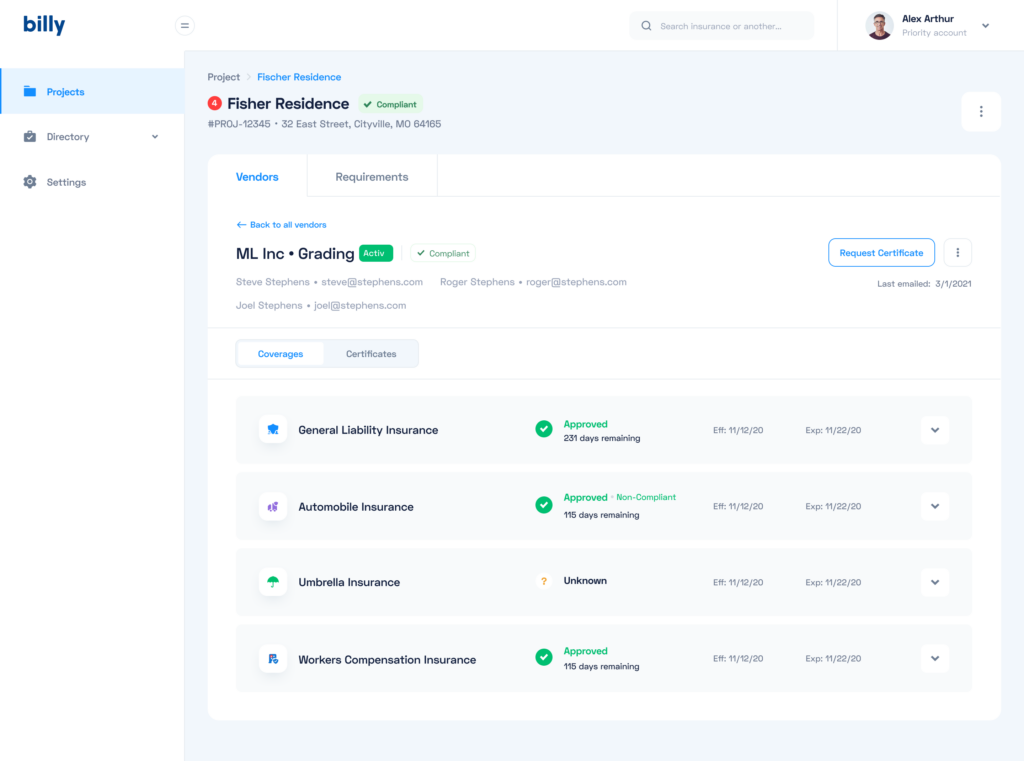

Billy, A Seamless Process to Manage Insurance Tracking

Achieving a compliance rate of at least 90% is a benchmark Billy strives for and makes attainable to all construction partners. The platform helps project teams automate the collection and verification of certificates of insurance, W9 forms, business licenses, and other compliance documents.

“ If you were to audit all of your vendors across all your projects, how confident are you that your compliance rate is at least 90%?”

How Billy Does It:

- Request insurance details from vendor contacts effortlessly.

- Save time with suggested insurance limits.

- Easily filter through coverages on Certificates of Insurance (COIs).

- Track compliance with a comprehensive vendor directory.

- Seamless integrations to Procore & Autodesk.

Business Impact:

- Simplify Insurance Tasks: Make insurance processes straightforward for quicker project completion.

- Avoid Project Delays: Prevent hold-ups caused by insurance challenges, keeping projects on track.

- Stay Secure: Guarantee your projects are protected, giving you a peace of mind.

- Save Time and Money: Cut down on expenses and time spent on experts or staff training for insurance matters.

Ready to Learn More?

Simplify insurance processes and fast-track your project timelines with Billy. Our smart risk management software minimizes operational and financial risks, ensuring smarter insurance management. With comprehensive coverage, hassle-free compliance tracking, and streamlined insurance operations at your fingertips, Billy is your partner in achieving efficient project execution and optimal financial protection.