The 2026 Construction Guide for General Contractors, Risk Managers, and Subcontractors

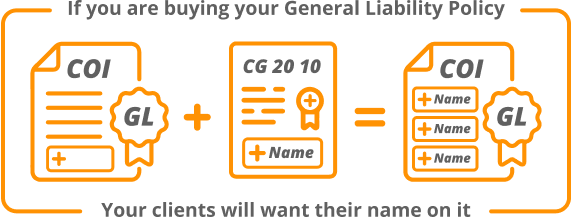

Insurance endorsements are where real risk transfer happens.

Not the COI.

Not the limits.

Not the pretty ACORD form.

If you’re a GC, risk manager, subcontractor, or broker, endorsements are the documents that determine whether you are actually protected in the event of a claim. This guide breaks down the most important endorsements in construction:

- CG 20 10 — Ongoing Operations Additional Insured

- CG 20 37 — Completed Operations Additional Insured

- Primary & Noncontributory (P&N)

In this compliance guide for construction, we will explain:

- What each endorsement does

- Why GCs require them

- The most common missing items

- Examples of language you should expect to see

- How AI can review endorsements in seconds

- How Billy automates checks and subcontractor follow-up

Let’s get into it.

What Is an Insurance Endorsement?

An insurance endorsement is a change (amendment) to an insurance policy. It changes the contract between the insurance company and the insured, specifying what the insurance policy is allowed to cover.

For construction projects, endorsements determine:

- Who is an Additional Insured

- Which Operations are covered

- Whether the General Contractor is primary in a claim

- Whether completed work and operations are included

- Whether insurance coverage applies to ongoing work

- Whether subrogation is waived

A COI cannot grant these rights. Only endorsements can. That’s why endorsement review is the most critical part of compliance.

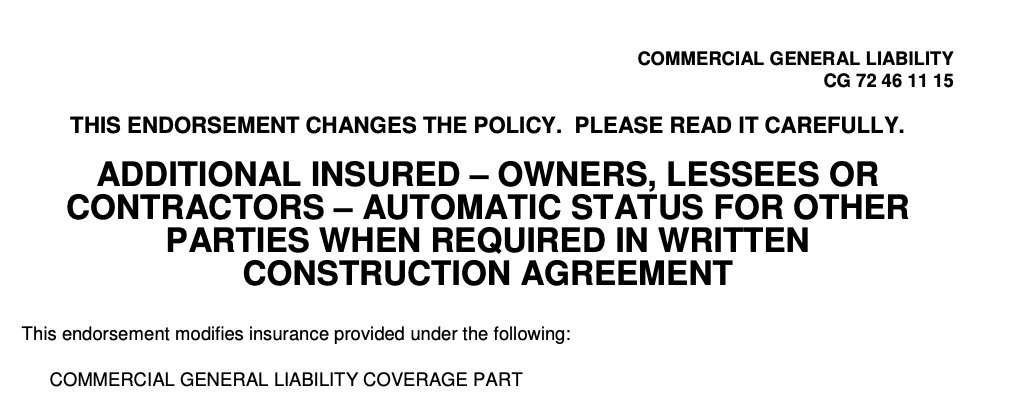

CG 20 10 : Additional Insured (Ongoing Operations)

What it does

CG 20 10 provides Additional Insured status to the GC, owner, or other upper-tier contractor while the subcontractor is still performing its work.

If a claim arises during construction, CG 20 10 protects the General Contractor.

Version matters

Older versions of CG 20 10 (prior to 2004) covered both ongoing and completed operations.

Modern versions (post-2004) only cover ongoing operations.

What you should expect to see

Look for phrases like:

- “Additional Insured — Owners, Lessees, or Contractors — Scheduled Person or Organization”

- “For ongoing operations only”

- “Coverage applies only with respect to liability caused in whole or in part by the acts or omissions of the Named Insured.”

Common failure points

❌ Endorsement missing entirely

❌ General Contractor not listed

❌ Coverage limited to premises only

❌ Only references a blanket AI but requires a schedule

❌ Applies only if a written contract exists (but no contract is uploaded)

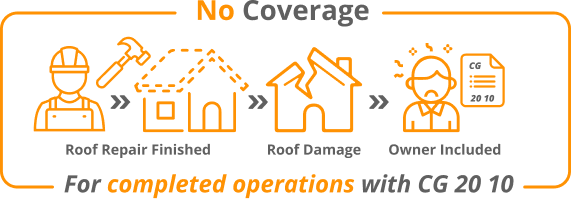

CG 20 37 : Additional Insured (Completed Operations)

What it does

CG 20 37 provides Additional Insured protection after the subcontractor’s work is finished.

This endorsement is critical because most claims occur after a project is complete. This is true especially for:

- Water intrusion

- Fire

- Defective installation

- Structural issues

What you should expect to see

Look for:

- “Additional Insured — Completed Operations”

- “Applies to ‘your work’ completed”

- “Coverage applies only for liability caused in whole or in part by the Named Insured.”

Common failure points

❌ Subcontractor provides CG 20 10 but not CG 20 37

❌ Expired policy does not include completed ops

❌ Completed ops limited to 0 years

❌ Blanket endorsement excludes completed operations entirely

Primary & Noncontributory (P&N)

What it does

A Primary and Noncontributory endorsement ensures:

- The subcontractor’s policy responds first

- The GC’s policy does not contribute to the claim unless the subcontractor’s limits are exhausted

Without P&N, a GC’s own policy could be forced to defend the claim first.

What you should expect to see

Language such as:

- “This insurance is primary”

- “This insurance shall apply without contribution from any other insurance available to the Additional Insured.”

Common failure points

❌ P&N endorsement missing

❌ P&N wording buried inside another section (not acceptable to many GCs)

❌ Endorsement references only liability arising out of premises

❌ Applies only if required by contract (but no contract uploaded)

The Real-World Risk If These Endorsements Are Missing

If CG 20 10, CG 20 37, or P&N are missing, incomplete, or expired:

- Claims can be denied

- GCs may be forced to tender to their own carriers

- Audits become expensive

- Brokers cannot defend coverage

- Projects face compliance delays

- Subcontractors may be barred from site

This is why endorsement review, not COI review, is the true risk driver.

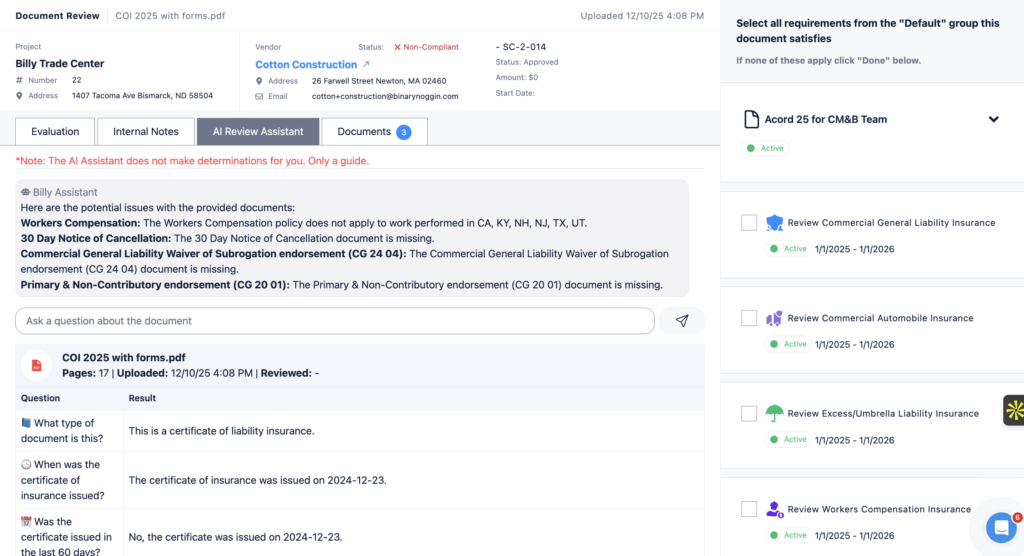

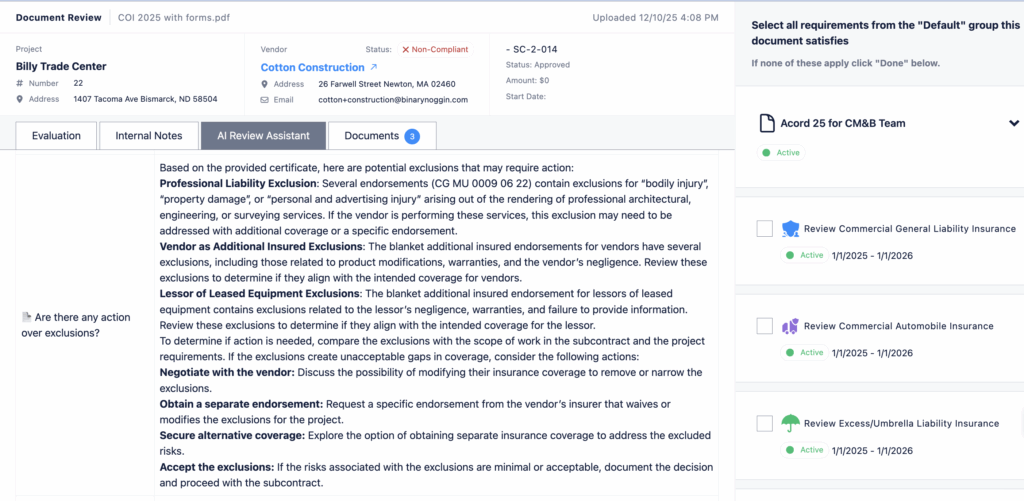

How Billy’s AI Analyzes Endorsements in Seconds

Billy’s AI is trained on:

- Thousands of endorsements

- Clauses from all major carriers

- Common compliance failures

- GC contract requirements

When a subcontractor uploads a policy, Billy automatically:

AI Checks

✓ Detects whether CG 20 10 is present

✓ Detects whether CG 20 37 is present

✓ Confirms Additional Insured wording

✓ Extracts P&N language

✓ Flags missing required endorsements

✓ Summarizes key coverage limitations

✓ Identifies blanket vs. scheduled AI coverage

✓ Reads Umbrella follow-form status

✓ Alerts project teams automatically

Then Billy sends smart reminders to subs until the correct endorsements are received.

This cuts review time from 30 minutes per vendor to under 10 seconds.

Billy’s AI Review Assistant

Instant COI review that removes the back and forth, guidance that helps vendors fix their own mistakes, and an AI assistant that answers questions without adding to your workload. Billy’s AI Review Assistant gives you fewer emails to manage, fewer corrections to chase, and a smoother approval process from start to finish.

Examples of AI Outputs

Detected: CG 20 10 (ongoing operations)

Issue: GC not listed as Additional Insured

Action: Notify vendor to provide updated blanket AI endorsement including GC

Detected: Missing CG 20 37 (completed operations)

Action: Request completed operations endorsement to ensure post-project coverage

Detected: P&N wording not present

Action: Flag for Risk Manager review

What GCs Should Require in Their Contracts

To protect yourself, your contract should require:

Minimum Requirements

- CG 20 10 (ongoing operations)

- CG 20 37 (completed operations)

- Primary & Noncontributory

- Waiver of Subrogation

- Additional Insured status for GC + Owner

- Umbrella follow-form coverage

Recommended Language

“Subcontractor shall maintain Additional Insured coverage for General Contractor and Owner for both ongoing and completed operations, including but not limited to CG 20 10 and CG 20 37, on a primary and noncontributory basis.”

Common Subcontractor Pushbacks (And How to Respond)

“My carrier can’t issue CG 20 37.”

→ They can. All major carriers issue it. They may charge a small fee.

“The COI shows the GC is an Additional Insured.”

→ A COI cannot grant AI status. Only the endorsement does.

“We only provide blanket AI endorsements.”

→ Blanket is acceptable only if it clearly covers the GC and both operations.

Why Billy Helps Reduce Claims & Audit Exposure

Billy ensures:

- Correct endorsements upfront

- Automatic monitoring for expiring policies

- Instant visibility inside Procore, Autodesk, Sage, JD Edwards

- A clean audit trail for carriers

- Zero manual review work for project admins

The result:

- Fewer claims disputes

- Faster vendor onboarding

- Lower internal labor costs

- Stronger risk posture for GCs

Conclusion: Endorsements Are the Heart of Risk Transfer

CG 20 10, CG 20 37, and Primary & Noncontributory endorsements determine whether your construction project is protected before, during, and long after work is completed.

With AI-powered COI review, Billy makes endorsement verification:

- Faster

- More accurate

- Standardized

- Audit-ready

- Fully automated

If you want to reduce risk, avoid denied claims, and eliminate hours of manual review, Billy is the modern way to manage construction insurance.

Want your subcontractor endorsements reviewed automatically with AI?

Book a demo and see how Billy reduces insurance risk by 70% → Schedule a Demo