A connected jobsite starts with connected data

For years, construction teams have relied on separate systems to manage project schedules, accounting, and compliance. Each tool served its purpose, but the gaps between them created friction, duplication, and risk.

Integrations between platforms such as Procore, Sage, and compliance solutions are now breaking down those silos. When these systems communicate, data flows automatically, teams stay aligned, and compliance moves from a static record-keeping exercise to a living, collaborative process.

The impact reaches far beyond convenience. Integrated systems are changing how construction companies manage documentation, assess risk, and build trust with their partners.

When systems don’t talk, risk grows

Disjointed software creates uncertainty. One system shows a certificate as current while another flags it as expired. Field crews begin work before accounting verifies coverage. Finance releases payments before risk has cleared a vendor.

These breakdowns cost time and erode confidence. A missing or outdated document can hold up pay applications, stall project progress, and even expose contractors to liability. As owners and insurers demand real-time proof of compliance, the limits of disconnected systems have become clear.

Integration solves this by giving every stakeholder access to the same source of truth. When project, vendor, and insurance data align, compliance becomes predictable instead of reactive.

How Procore integrations support continuous construction compliance

In the past, compliance was handled at the beginning of a project and revisited only when a problem surfaced. Integrations have replaced that reactive model with continuous visibility.

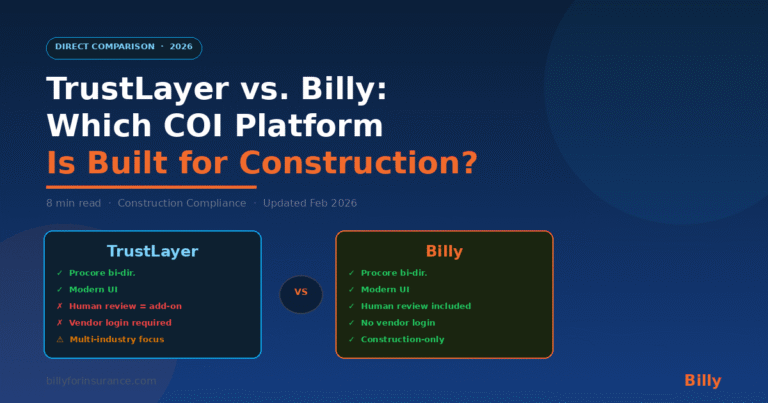

When tools like Billy and Procore share data automatically, every document update, policy renewal, or missing endorsement is visible immediately. Controllers, project managers, and risk teams can address issues early, keeping projects moving.

This real-time view has a measurable impact. One mid-size general contractor that connected Billy with Procore cut its COI processing time by more than 60 percent and reduced payment delays on active jobs. Efficiency improves, but so does accuracy because data is verified once and shared everywhere.

The payoff: time, accuracy, and accountability

Integrated workflows eliminate duplicate entry, reduce manual uploads, and maintain consistent information across teams. Each compliance document is time-stamped and traceable, creating a clear audit trail for owners and carriers.

That transparency builds confidence. Owners see that coverage is current, subs know exactly what is required, and contractors spend less time chasing paperwork. Integration turns compliance from a bottleneck into a performance advantage.

From integration to insight

The next frontier of construction technology lies in how connected systems use data. Once compliance, project, and financial data are linked, risk managers can begin to identify patterns and predict exposure before it happens.

AI-driven analytics are starting to surface trends such as vendors with recurring coverage lapses or regions with higher renewal risks. These insights allow contractors to plan proactively instead of reacting after a deadline passes. Integration lays the foundation for that intelligence.

Building smarter with Billy

As construction teams embrace this connected model, the next challenge is managing compliance across the systems they already use. Billy was built for exactly that.

Through integrations with Procore, Sage, and other leading platforms, Billy automates certificate tracking, vendor onboarding, and renewal reminders.The result is clearer compliance visibility that helps contractors stay audit-ready and pay-ready across active projects.

By eliminating redundant processes and increasing visibility, Billy helps contractors focus on what they do best: building. In an industry where every delay carries cost, integration is more than efficiency. It is the foundation of smarter, safer construction.

Frequently Asked Questions About Construction Insurance Audits

Integrations matter because they remove the gaps that cause compliance issues. When Procore, accounting tools, and compliance platforms work separately, information becomes inconsistent and teams make decisions based on outdated or incomplete data. Connecting these systems creates a centralized source of truth that keeps COIs, endorsements, vendor status, and project details accurate in real time. This reduces risk and prevents delays tied to missing or expired documentation.

Payment delays often occur when compliance documents are missing, expired, or scattered across inboxes and folders. When compliance tools like Billy integrate with systems such as Procore, vendor insurance status updates automatically in one place. This gives project teams clear visibility without manual uploads or repeated cross-checking, helping pay applications move forward and reducing the time spent following up on documentation.

Yes. When project, financial, and compliance data are connected across systems, contractors gain clearer visibility into trends that are difficult to spot manually. Integrated platforms can surface patterns such as recurring coverage lapses, late renewals, or vendors that consistently require follow-up. This added visibility helps teams address potential issues sooner, reducing the chance of delays or unexpected compliance exposure and supporting a more proactive approach to risk management.