In construction, few documents cause more confusion than Certificates of Insurance and insurance endorsements. Some construction teams treat them the same, but they play very different roles in protecting a project and your company. The problem is that misunderstanding these documents can leave a general contractor completely exposed during a claim.

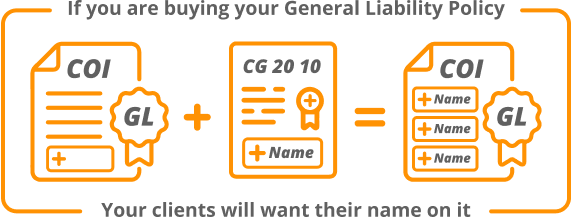

Our team talks to contractors every day who tell us they received a COI from their subcontractor and assume they are covered. The reality is that a COI only shows that a policy exists. It does not guarantee that the general contractor has any protection under that policy. The protection comes from endorsements, and without them, the COI is almost meaningless.

This is one of the biggest blind spots in risk transfer today.

What a COI Actually Does

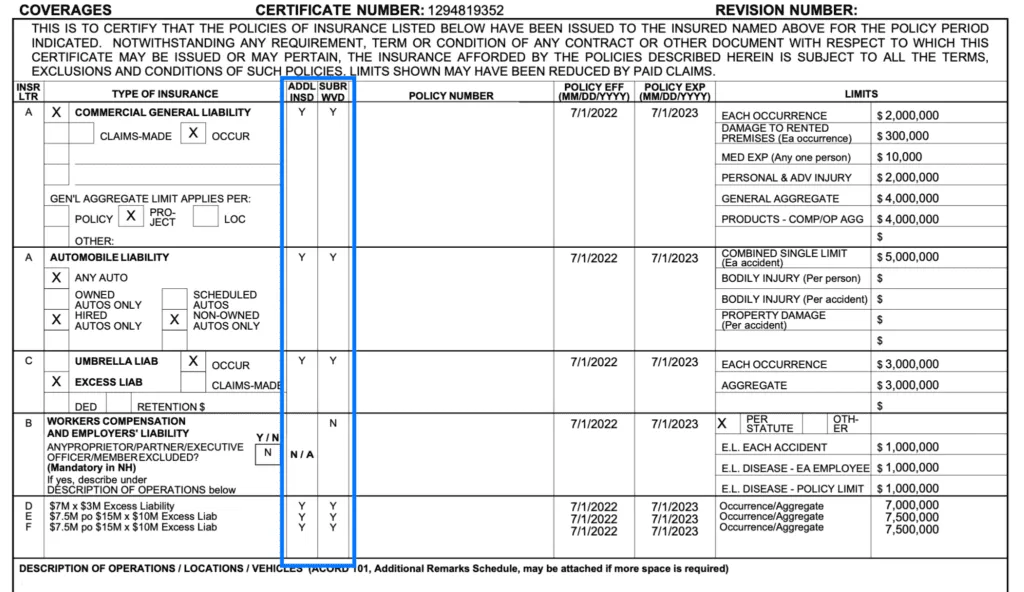

A Certificate of Insurance is proof that a subcontractor had insurance on the date the Acord25 was created. It lists coverage types, limits, effective dates, and carrier information. It helps confirm that insurance policies exist, but that is where their value ends.

A COI is not legally binding. It does not amend the policy. It does not transfer risk. It does not give you the rights of an insured party. If a claim occurs, the carrier does not rely on the COI to determine whether you have coverage. They look at the endorsements attached to the policy.

“Many contractors understand this, but fail to operationalise the process, which is why so many claims end up denied.” Sarah Shepard McGuinness

What an Endorsement Actually Does

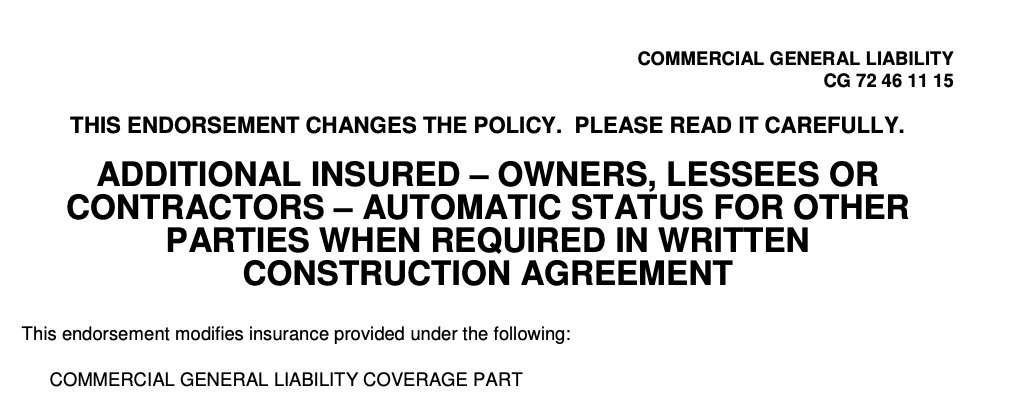

An endorsement is an addition or subtraction to an insurance policy. It is the document and language that determines who is covered, how the coverage applies, when it applies, and what exclusions exist. It is a part of the policy that actually affects the outcome of a claim.

If a general contractor wants to be added as an Additional Insured, that is done through an endorsement. If the General Contractor wants a Waiver of Subrogation or Primary and Non Contributory wording, that is done through an endorsement. If the General Contractor wants protection during ongoing operations and after the work is complete, that is done through endorsements.

This is why endorsements matter far more than the COI itself. They are the actual mechanism of risk transfer.

The Two Endorsements That Matter Most

There are many endorsements in commercial general liability policies, but two are essential for construction.

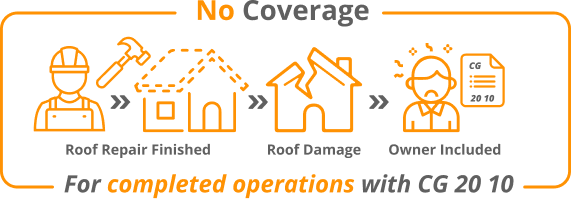

CG 20 10

The CG 20 10 covers the additional insured for liability arising from your ongoing operations. “Ongoing operations” does not include “completed operations.” This endorsement applies during ongoing operations. The easiest way to think about it is to imagine a security guard standing at the door of a party. As long as people are still arriving and things are active, the guard is there to ensure everything runs smoothly. CG 20 10 protects the general contractor while the subcontractor is actively performing work.

CG 20 37

This endorsement applies after the work is complete. Imagine the party is over and people have gone home. You later discover damage you didn’t notice earlier. CG 20 37 protects you from claims that arise after completion. Completed operations claims are common in construction, which makes this endorsement essential.

You need both of these endorsements to be fully protected. If either is missing, you are exposed.

Ongoing Operations Occurrence, Example:

Say after 5 weeks after you finish the roof, the chimney falls over on the neighbor’s greenhouse. This is property damage out of your completed operations since to job has been completed. Once again, the neighbor sues the property owner.

If the property owner was named as an additional insured using the current CG 20 10, the property owner would not have covered for the completed operations exposure as this is not ongoing operations, as your completed work caused the damage.

The property owner would not have coverage for the completed operations exposure under the contractor’s CGL policy. The current form CG 20 10 after 1985 does not provide coverage to the additional insured for completed operations. It only provides coverage for ongoing operations, and this was a completed operations exposure.

If they also wanted coverage for completed operations, they would need a CG 20 37 endorsement.

COI vs Endorsement: Why the Difference Matters

A COI confirms that insurance exists. An endorsement determines whether you are actually covered.

This distinction is the foundation of risk management in construction. A contractor who collects COIs without verifying endorsements is collecting paper, not protection.

Why Manual Review Fails

Most contractors still review COIs and endorsements manually. The process is slow, inconsistent, and often inaccurate. Endorsements from different carriers use different language. Many subcontractors upload incomplete packets. Some send outdated forms or drop off coverage mid project without telling anyone. It is impossible for a human reviewer to keep up with hundreds or thousands of vendor documents across multiple jobs and multiple years.

That is exactly why Billy built AI directly into the compliance workflow.

How Billy’s AI Reviews COIs and Endorsements

Billy uses embedded AI models trained specifically on construction insurance documents. The system reads COIs and endorsements the way a human risk manager would, but with perfect consistency.

Billy automatically identifies whether the required endorsements are present, including:

- CG 20 10

- CG 20 37

- CG 24 04

- Primary and Non Contributory language

- Additional Insured status

- Waivers of Subrogation

- Completed operations language

- Ongoing operations language

Our AI Review Assistant checks each document against your project-specific insurance requirements and flags any missing or incorrect items. You get a simple, accurate compliance status without digging through PDFs or emailing carriers.

Automated Communication With Subcontractors and Brokers

Most compliance delays come from vendors who forget to send documents or do not know what is required. Billy solves this by automating communication.

Vendors receive precise requests for the documents your project requires. They upload directly into Billy, and the AI reviews the documents instantly. If an endorsement is missing, the vendor sees it right away. If the policy expires, Billy automatically follows up. If the broker wants to upload on behalf of their client, they can.

This creates a smooth, predictable workflow that eliminates back-and-forth and improves compliance across every project.

The Future of Risk Transfer Is AI Driven

Construction risk is increasing, claim costs are rising, and carriers are tightening their requirements. COIs alone are no longer enough. Manual workflows are too slow and too unreliable.

AI is becoming the new standard for insurance compliance in construction because it eliminates human error, ensures true endorsement level protection, and keeps projects moving without friction.

Contractors who adopt AI powered compliance systems now will be the ones operating with speed, certainty, and lower risk over the next decade.

Why GCs Choose Billy

Billy combines AI extraction, automated endorsement review, subcontractor workflows, and integrations with Procore, Autodesk, Sage 300, Intacct, Vista, JD Edwards, and other core systems. It creates a comprehensive compliance process that protects the job, the General Contractor, and the bottom line.

When you automate risk transfer, you win bigger projects, reduce administrative overhead, and reduce exposures that can cost millions.

That is how a company becomes category defining. And that is how your customers win.

Want to See Billy’s AI Review a COI or Endorsement Instantly

Book a demo at: https://billyforinsurance.com/request-demo/

Or activate your free 30 day trial during any industry event.