In a recent update that might stir conversations within the insurance sector, State Farm General Insurance Company, based in Bloomington, IL, has seen a significant adjustment in its financial ratings.

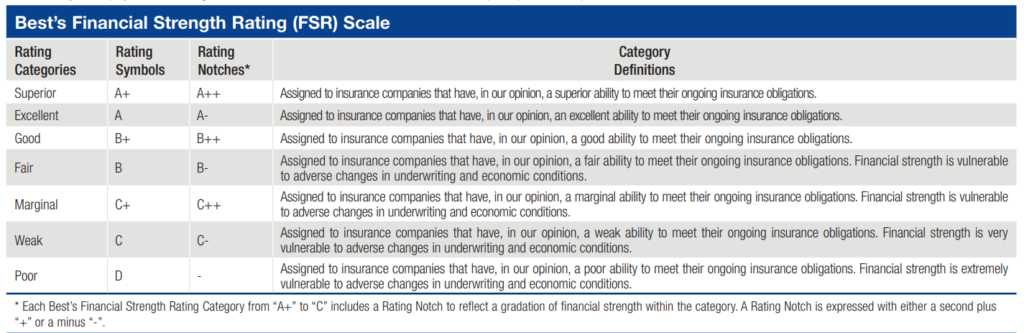

AM Best, the global credit rating agency with a focus on the insurance industry, has recalibrated State Farm General’s Financial Strength Rating (FSR) from an ‘A’ (Excellent) to a ‘B’ (Fair). This change underscores a noticeable shift from a previously solid rating to one that suggests more caution for contractors managing subcontractor certificates of insurance.

Alongside the FSR, the Long-Term Issuer Credit Rating (Long-Term ICR) was also adjusted downward from “a” (Excellent) to “bb+” (Fair).

A notable aspect of this update is the revised outlook for the FSR, which has moved from stable to negative, suggesting a kind of equilibrium has been reached despite the downgrades. However, the outlook for the Long-Term ICR remains negative, highlighting ongoing uncertainties and challenges ahead.

These rating adjustments are not made lightly. They reflect a variety of factors concerning State Farm General’s financial health, notably its balance sheet strength, which AM Best now considers weak. The company’s operating performance is marginal, alongside a neutral business profile and an appropriate level of enterprise risk management (ERM).

Further details on the reasons behind the downgrades include a continued decline in the company’s policyholder surplus as of the end of 2023. This decrease has negatively impacted its overall risk-adjusted capitalization, a key measure of financial stability in the insurance world. Particular challenges cited include significant increases in claim severity in specific lines of business, such as umbrella and commercial multi-peril policies.

The ongoing negative outlook on the Long-Term ICR is attributed to uncertainties around the company’s capability to stabilize and bolster its financial resilience amidst profitability challenges, adverse reserve developments from previous accident years, and a difficult regulatory landscape in California. This environment has made it tough for State Farm General, and similar companies, to adjust premium rates as needed swiftly.

Despite these hurdles, State Farm General’s management team is actively taking steps to address these issues, aiming for a more stabilized financial standing in the future. However, these efforts will require time to manifest fully into positive outcomes.

AM Best’s announcements are pivotal for those keeping a keen eye on the insurance sector, offering critical insights into financial health and stability especially for General Contractors who subcontract work and manage certificates of insurance.

For more in-depth information on this rating update, AM Best’s website is a comprehensive resource for industry analysis and updates.

In summary, while State Farm General faces challenges, the stable outlook on its FSR provides a silver lining. The insurance giant is at a pivotal point, and the industry will be watching closely to see how it navigates these turbulent waters. With strategic adjustments and a focus on overcoming current obstacles, there’s a pathway forward for State Farm General to regain its footing and strengthen its market position.

Source: https://www.businesswire.com/news/home/20240328609308/en/