Construction projects inherently come with risks. Having proper insurance coverage is crucial to mitigating those risks and ensuring smooth operations.

Equally important is understanding how that insurance is presented, verified, and tracked. This is where certificates of insurance (COIs) become essential. For general contractors, subcontractors, or anyone involved in construction, knowing where to get a COI and how to interpret it is key to effective risk management.

What Is a COI?

A certificate of insurance (COI) is a standardized document, typically issued using the ACORD 25 form, that summarizes the essential details of an insurance policy. It is a snapshot of coverage, providing project managers and general contractors with the necessary information to verify that subcontractors carry adequate insurance. This is particularly important in construction, where compliance with insurance requirements is often a prerequisite for starting work.

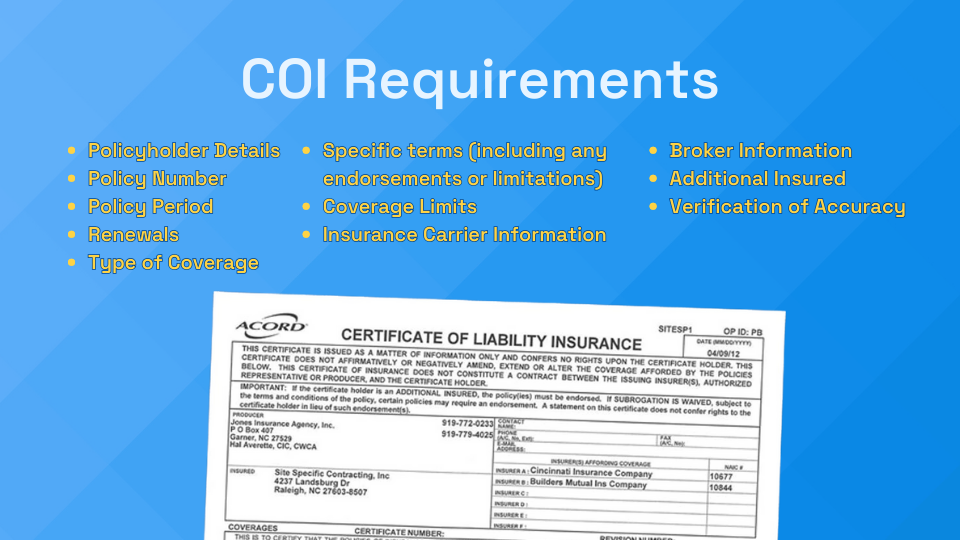

A COI typically includes:

- Policyholder Details: Name and company of the insured.

- Policy Number: Unique identifier for the insurance policy.

- Policy Period: Active and expiration dates of coverage.

- Type of Coverage: General liability, workers’ compensation, auto liability, umbrella coverage, etc.

- Coverage Limits: Dollar limits for each type of coverage.

- Insurance Carrier Information: Details of the company providing coverage.

- Broker Information: Contact details for the insurance broker.

How Do I Get a COI?

If you’re a subcontractor wondering, “How do I get a COI?” the answer is straightforward: you can request one directly from your insurance provider or broker.

Typically, COIs are issued at no additional cost and are customized based on the specific requirements of the job or contract. For general contractors, knowing where to get a COI from your subcontractors is vital to ensuring all project participants meet compliance standards.

Common Challenges in COI Verification

Unfortunately, COIs are not immune to errors or fraud. To avoid pitfalls, project managers must establish a robust COI management process. This ensures that insurance policies match the requirements of the construction project.

Key areas to verify include:

- Policy Coverage: Ensure all necessary policies—general liability, auto liability, umbrella, and workers’ compensation—are listed.

- Coverage Limits: Confirm that limits meet or exceed the project’s requirements.

- Policy Validity: Check that the policy is active and will remain so throughout the project.

- Additional Insureds: Verify that the COI includes endorsements listing your company as an additional insured.

- Per Project Coverage: Confirm the policy offers per project aggregate limits rather than shared limits across multiple projects.

Why COI Management Is Critical

Failure to properly review and verify COIs can expose general contractors to significant risks. For instance, if a subcontractor provides a fraudulent or expired COI and an incident occurs, the liability could transfer to the general contractor.

Here are some of the most common issues:

- Missing or incomplete endorsements.

- Incorrect policy details, such as mismatched policy numbers or missing dates.

- Failure to update expired COIs.

To prevent these risks, every project team should follow a standardized COI tracking process. This includes meticulous review, timely updates, and clear communication with subcontractors.

How Technology Simplifies COI Management

COI management can be a real pain in the ask. Insurance policy documents can span over 100 pages, and manual review is prone to human error. That’s where advanced technology platforms like Billy come into play. By digitizing and automating COI tracking, Billy eliminates many of the headaches associated with construction compliance.

Features of Billy’s COI Management Platform

Centralized Storage

Store all COIs and related documents in one secure location, accessible anytime.

Automated Reminders

Receive notifications when COIs are nearing expiration to ensure no lapses in coverage.

Real-Time Updates

Track changes and updates to COIs across all projects.

Mobile Access

Access COI data from any internet-connected device, whether in the office or on-site.

Error Reduction

Minimize manual data entry and reduce the risk of mistakes.

Benefits for Subcontractors and General Contractors

- For subcontractors: Simplifies answering the question, “Where do I get a COI?” and ensures they meet all requirements quickly and efficiently.

- For general contractors: Provides peace of mind knowing that all COIs are verified, up-to-date, and compliant with project specifications.

Why Choose Billy for COI Management

Billy is more than a technology solution—it’s your partner in construction compliance.

By centralizing COI data and automating the tracking process, Billy reduces administrative burdens and enhances risk management. Whether you’re dealing with COIs for subcontractors or exploring how to get a COI yourself, Billy simplifies the process from start to finish.

To add even greater convenience, anyone on your team can access the information via mobile phone, laptop, or any other internet-connected device. With Billy, construction risk assessments can be conducted at a moment’s notice. You can also manage all certification-related activities (including communication with subcontractors) from a single platform, adding even greater convenience and oversight into operations.

Streamline Your COI Management: Ensure Compliance and Focus on Building Success

Certificates of insurance are a vital part of managing construction risk, but they don’t have to be a source of stress.

By understanding how to read a COI, knowing where to get a COI, and implementing a robust COI management plan with Billy, you can ensure compliance, protect your business, and focus on what you do best—building.

Frequently Asked Questions

Why would a vendor ask for a COI?

A vendor requests a Certificate of Insurance (COI) to verify that contractors or subcontractors have adequate coverage. This ensures that all parties are protected from liability risks, such as property damage or injury on-site.

Why are Certificates of Insurance important?

COIs are crucial because they provide proof of insurance coverage, including policy limits and active status. They help protect businesses from liability by ensuring compliance with project-specific insurance requirements.

What is COI compliance?

COI compliance refers to meeting the specific insurance requirements outlined in contracts. It involves verifying that the COI accurately reflects the necessary coverage, including policy details, limits, and endorsements, to protect all parties involved in a project. COI tracking solutions such as Billy offer a streamlined and automated process to help you track and manage construction compliance seamlessly.