Almost all development projects around the world rely on construction loans. Navigating the construction insurance industry presents a unique set of challenges, particularly when it comes to compliance and making sure you’re covered.

From safety regulations to environmental standards, construction firms must adhere to many laws and guidelines. Non-compliance not only risks hefty fines but can also jeopardize projects, damage reputations, and endanger workers.

Let’s explore the top five most common construction compliance issues facing the construction industry today and practical solutions to help you mitigate risks and stay compliant.

Understanding Construction Insurance

Most private residential and commercial projects depend on bank loans or private equity. Funding is commonly provided by public-private partnerships, or municipal bonds for federal and state projects, such as airports, highways, schools, hospitals, and water infrastructure.

Builders Risk Insurance protects construction loans. Builders Risk is a specialized type of property insurance that covers the physical structure and materials during the construction phase. It protects against fire, theft, vandalism, and specific weather events, which could otherwise halt construction and threaten the project’s substantial completion date. This causes financial harm to the owner, who, therefore, cannot use their property or convert the loan to a mortgage, thus jeopardizing the loan repayment to the lender.

Additionally, lenders require Builders Risk Insurance as a condition for financing all construction projects. The insurance ensures that if any damage occurs to the project during construction, the losses will be covered, allowing the construction to continue and protecting the lender’s investment.

Without this coverage, a significant loss could delay or halt the project, putting the loan at risk of default due to insufficient collateral. Additionally, some Builders Risk policies can include soft cost coverage, which covers expenses such as loan interest, legal fees, and additional administrative costs if a project is delayed due to a covered event.

By reducing financial risk during construction, Builders Risk Insurance gives both lenders and developers peace of mind that the project can reach completion, even if unforeseen events occur.

In partnership with USI Insurance, general contractors and property owners are more likely to receive insurance favorability on their Builders Risk Premiums and gain efficiencies by deploying compliance risk mitigation solutions such as Billy and TrueLook.

Top Construction Compliance Issues

Here are the Top 5 common construction compliance Issues and how addressing them can lead to improved insurance outcomes for Builders Risk Insurance.

1. Not Having a Strong Construction Insurance Partner

A standard yet often overlooked issue is failing to partner with an insurance broker who understands the specific needs of the construction industry. USI Insurance is a leading insurance broker that provides tailored risk management solutions custom-fit for each contractor’s unique needs.

USI’s proprietary PATH™ program is a technology-enabled platform that combines expert risk management insights with industry-specific data, helping contractors identify risk areas and choose the best insurance products. USI’s USI ONE Advantage® approach integrates analytics and local market expertise to offer customized insurance solutions.

By working closely with brokers like USI and using tools like Billy and Truelook, contractors and owners can ensure that their insurance coverage aligns with their operational risks. In addition, this leads to more favorable business outcomes that reduce operational risk while gaining back-office efficiency. This integrated approach reduces manual tasks, allowing contractors and owners to focus on their projects while ensuring compliance, which insurers appreciate and often reward with better rates.

2. Missing or Expired Certificates of Insurance (COIs)

One of the most common compliance challenges is maintaining up-to-date Certificates of Insurance (COIs) on each project for every subcontract. On average, customers who use Billy manage 637 COIs each year. Missing or expired COIs expose builders and owners to significant liability if a subcontractor’s insurance is insufficient or lapses during the project when an incident or insurance claim occurs on-site.

Billy’s automated COI tracking system alleviates this burden by ensuring all COIs are verified, current, and easily accessible in your systems such as Docusign, Procore, Autodesk, Sage300, CMiC, JD Edwards, Viewpoint Vista, and more. This integrated approach bridges the gap between construction and insurance through automation that minimizes the risk of coverage lapses, which insurance carriers view as a favorable factor in obtaining a favorable Builders Risk Insurance premium on your project.

USI brokers work with contractors daily to assess their risk exposure, and those who use effective COI tracking solutions like Billy are likely to reap financial benefits from time savings, billing for Billy as a project tool, and lower construction premiums.

3. Lack of Proper Construction Site Monitoring

Construction sites are often targeted for theft and vandalism, which are frequent claims under Builders Risk Insurance insurance policies. The National Equipment Register estimates equipment theft costs the construction industry between $400 million and $1 billion annually.

Using TrueLook’s real-time construction monitoring solutions provides 24/7 site surveillance, reducing the likelihood of theft and improving overall site safety compliance. TrueLook’s monitoring system also documents incidents in real-time, which can be used as evidence during insurance claims.

Construction Insurance professionals like USI Insurance view advanced site monitoring as a way to lower risk, often rewarding contractors with favorable insurance premiums.

4. Failure to Verify Subcontractor Qualifications

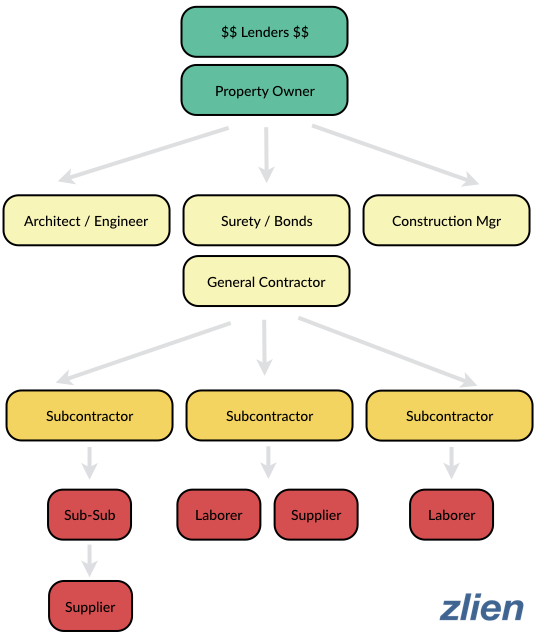

Hiring unqualified subcontractors is a significant risk in construction projects. Subcontractors must be systematically vetted for financial strength, insurance coverages and claims history, bonding, licensing and checking references before a contract can be issued.

Hiring unqualified subcontractors leads to delays, and construction defects that lead to lawsuits settled by costly insurance claims. Verifying that all subcontractors have the financial capacity, insurance coverage, bonding ability, and safety standards is the first step in any relationship.

With Billy’s vendor prequalification tool, contractors automate the verification process, ensuring that only qualified and compliant subcontractors are hired. This reduces the likelihood of incidents and claims, which lowers your overall risk profile.

5. Poor Documentation and Record Keeping

Adequate documentation is critical for construction compliance. Poor record-keeping practices can result in missed compliance deadlines, disputes, and higher insurance claims, negatively impacting Builders Risk Insurance premiums.

TrueLook’s integrated documentation system, combined with Billy’s automated compliance management, ensures that all relevant documents—such as COIs, safety inspections, and subcontractor qualifications—are centralized, up-to-date, and accessible in systems like Procore and Autodesk.

This robust documentation management embeds insurers like USI Insurance to work with insurance carriers to offer better rates to contractors who can present thorough and accurate documentation during the underwriting process.

How Billy, TrueLook, and USI Insurance Help Lower Builders Risk Premiums

Partnering with USI Insurance, an expert in construction risk management, and using compliance solutions like Billy and TrueLook provides contractors with a comprehensive approach to risk control. USI Insurance combines its industry expertise with analytics to help contractors reduce risks and secure more favorable Builders Risk Insurance premiums.

By automating compliance tracking, improving site security with video monitoring, and streamlining documentation, contractors can protect their projects from unnecessary risks and lower insurance costs. USI Insurance supports these efforts through their PATH™ program, which integrates best-in-class technology and tailored insurance solutions to offer comprehensive coverage at competitive rates.

For more information on enhancing your compliance management, schedule a custom demo today.

Frequently Asked Questions

Compliance ensures safety, quality, and legal adherence in construction projects. It minimizes risks of accidents, legal issues, and financial penalties. To ensure your projects remain compliant, compliance management software helps to streamline adherence by tracking documentation, managing audits, and ensuring all stakeholders are informed and accountable. By automating compliance processes, software like Billy reduces the risk of errors, enhances reporting capabilities, and fosters a culture of safety, ultimately protecting workers and minimizing costly penalties.

A Certificate of Insurance (COI) in construction is a document that verifies a contractor or subcontractor holds the necessary insurance coverage. COIs outline the types of coverage, policy limits, and the effective dates. This certificate assures project owners and stakeholders that they are financially protected against potential risks or liabilities associated with the construction project.

Contractors typically use general liability insurance, commercial auto insurance for vehicles used in business, professional liability insurance, builder’s risk insurance for property damage during construction, and equipment insurance. These coverages help mitigate risks and protect both contractors and clients.