General Contractor CFOs are seen as the financial architects behind the scenes in construction. A less discussed subject is how CFOs help General Contractors navigate the intricate risk landscape.

Risk in Construction

In the construction world, risks can come in many forms, like projects running late, over budget, accidents, or unexpected events. People in charge, like CFOs and Risk Managers, work closely with insurance experts to determine the best ways to protect their companies from these risks.

To understand this topic, we sat down with Brian Hunt, an insurance industry veteran on a mission to make risk management a breeze for the construction industry with innovative tools like Billy.

Who is Brian Hunt?

Brian Hunt is the Vice President Of Construction at USI Insurance and the founder of “60 Seconds Of Risk”. With years of industry experience, Brian is on a mission to simplify insurance knowledge for construction companies of all sizes so that they can make an informed decision on the best coverage for their business needs.

Brian partners with platforms such as Billy to help General Contractors digitize compliance workflows such as tracking Certificates Of Insurance, Business Licenses, W9s, and Certified Payroll into one easy place that integrates with popular project management software like Procore & Autodesk.

Brian’s journey into construction insurance was driven by a desire to help business owners protect what matters most to them – their employees and assets. His passion for simplifying complex concepts led him to develop initiatives like “60 Seconds of Risk,” where he breaks down insurance jargon into easily digestible bits, empowering insureds to make informed decisions every Friday on Linkedin.

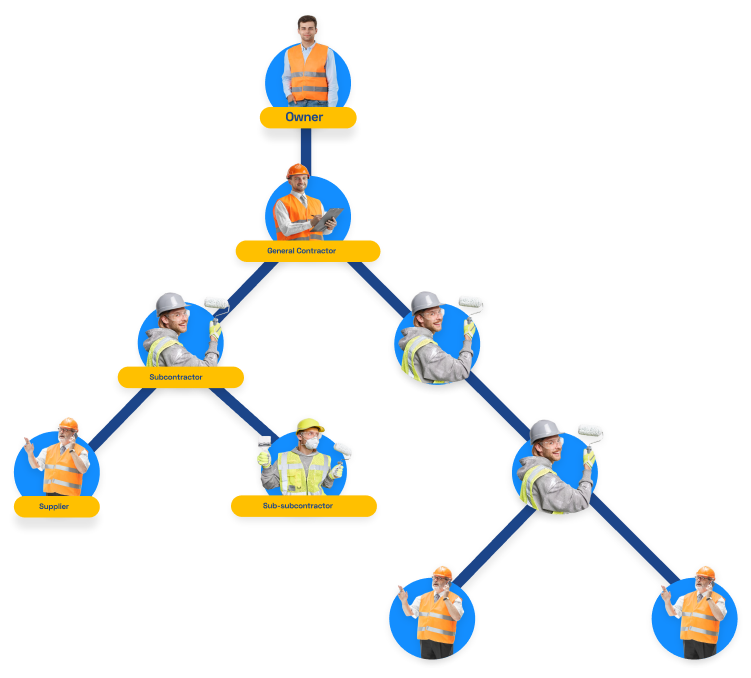

Are your subcontractors covered?

In the construction industry, it’s common for a general contractor to request proof of insurance from subcontractors before commencing work on a project. This same practice applies when subcontractors hire sub-subcontractors (a/k/a sub-tiers). Proof of insurance typically comes in the form of a standardized document known as a “certificate of insurance, or COI.”

The traditional operating procedure at most companies is to collect this certificate of insurance from the subcontractor, check the expiration date and limits, and then store it away without further scrutiny until the following year.

However, when a problem arises, the signed contract, certificate of insurance, and other underlying policy documents (policy documents, endorsements) become the primary documents to reference during an insurance claim. This exact situation happened with Kelsey VanSleen. Kelsey was an Accounting Manager for a Commercial GC in Denver, Colorado, in her former role.

“One of our subcontractors had a serious injury on site. The root cause of the injury was a scheduling issue where the Superintendent had the wrong trades on the job site at the wrong time. This led to traded “tripping” over each other, leading to the fall that resulted in injury. Our team scrambled to find their COI to file a workers’ compensation claim. Sadly, we didn’t have a certificate of insurance on file for that subcontractor, so we had to file a claim under our policy. This resulted in increased premiums the next year and a substantial audit charge of over 6-figures for not having COIs on file. It was a huge learning experience. We realized how important compliance tracking was to our bottom line.”

A COI does not mean you are covered.

A Certificate of Insurance (COI) does not guarantee insurance coverage from your vendor or subcontractor. General Contractors must be vigilant when confirming their protection by:

- Signing Contracts

- Requesting certificates of insurance

- Request policy documents (Declaration Page, Endorsements)

- Have an expert review the policy language to ensure you are covered

Merely receiving a COI from a subcontractor does not inherently guarantee that the subcontractor’s insurance policy will extend coverage to damages or injuries arising from their work. The COI may not precisely detail the coverage limitations or exceptions within the underlying policy, which could result in a denial of coverage.

The Significance of Named Insureds & Additional Insureds

Certificates of insurance are not legally binding in many parts of the United States. They can only add new benefits or legal duties stated in the policy. In the case of Moleon v. Kreisler Borg Florman Gen. Const. Co., 758 N.Y.S.2d 621, 623 (N.Y. App. Div. 2003), the general contractor was given a certificate of insurance by a subcontractor’s insurer that said the general contractor was an additional insured under the subcontractor’s insurance policy.

A statement on the insurance certificate said, “This certificate is issued for informational purposes only and gives the certificate holder no rights. This certificate does not amend, extend, or change the coverage provided by the policies.” The New York Supreme Court, Appellate Division, adopted this statement in determining that the general contractor was not an additional insured because their subcontractors insurance policy did not list them as an additional insured.

To put it differently, the statement on the COI that names the general contractor as an additional insured does not mean anything if the general contractor is not listed in the policy.

Check for Residential Exclusions

Insurance can be complex, but let’s break down Exclusions. Exclusions are like rules in your insurance policy that decide what’s covered and what’s not. For subcontractors who mainly work on houses, there are some rules specifically about residential jobs.

If your subcontractor mainly fixes up houses and hardly ever builds new ones, it makes sense for their company to add a rule (Exclusion) to their insurance policy since they don’t do new home construction. This makes their insurance cheaper because they are reducing what their insurance carrier has to cover.

You can not see residential exclusions on a COI.

Imagine you’re a general contractor overseeing a big project and hired a subcontractor to work on a residential part of the job, like renovating a house. The subcontractor has their insurance policy, and you collected their COI, and it has the limits and expiration dates checked out.

Let’s say something goes wrong during the subcontractor’s work, causing property damage and bodily injury to the occupants in the house they were renovating. If their insurance policy has that rule (Exclusion) that excludes home renovations, their insurance company will say, “Sorry, we won’t pay for this because it’s a residential renovation project, and we don’t cover that.”

So, the problem is that if someone is injured, the property damage is still there, and someone has to pay for it. If the subcontractor’s insurance won’t cover it, the responsibility for fixing the damage could fall on you as the general contractor, the project owner, the lender, or others involved.

This is why everyone involved in a construction project must understand these exclusions and ensure they have the right insurance coverage to avoid unexpected costs and complications.

With Billy, you can request the endorsements and declaration pages to check for residential exclusions, such as

- Not covering the framework of new houses.

- Not covering damage caused by the ground moving (like earthquakes).

- Saying no to insuring new home construction.

- Not covering work in medical facilities.

Conclusion: Understanding and managing risk is paramount for General Contractor CFOs. Brian Hunt’s insights and innovative tools, like Billy offer a valuable roadmap to navigate the insurance landscape, providing peace of mind and financial protection in an industry where uncertainty is part of the job. With his dedication to simplifying risk management, Brian and Billy are a true asset for CFOs in the construction sector and beyond.