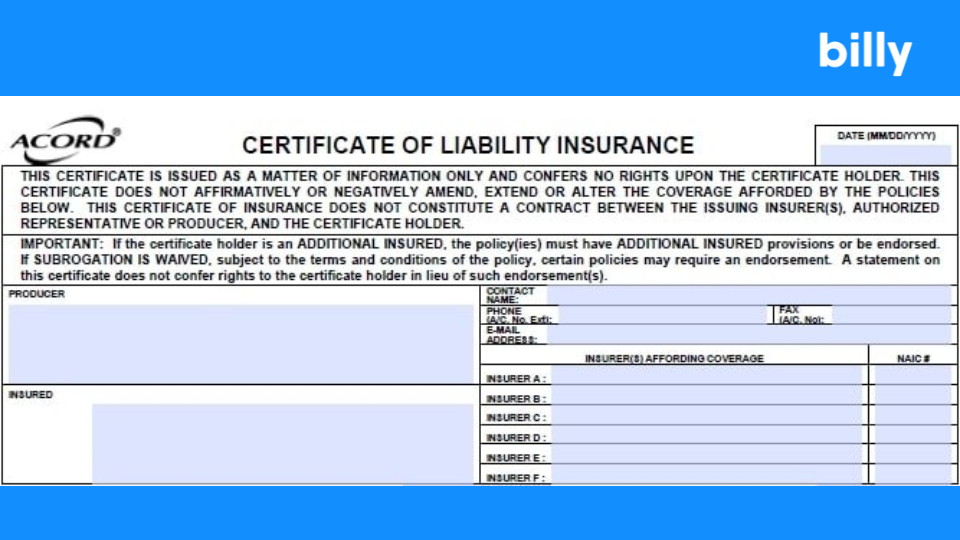

In construction, clients are required to present a Certificate of Insurance (COI) to ensure that your business has the insurance coverage necessary to complete the job as defined in the signed contract. The COI document serves as proof of insurance, typically provided on an ACORD 25 form. It summarizes coverage details about your policy, such as coverage type, limits, endorsements, and effective dates.

If you’re wondering ‘how to get a COI’ or ‘where to get a COI’, understanding the process can simplify your workflow and help you get on the job and paid much faster. Here’s what contractors need to know:

What is a Certificate of Insurance (COI)?

A COI is a standardized document that verifies the existence of an insurance policy and summarizes its terms, including coverage types, limits, and policy dates at a point in time. A certificate of insurance is issued for information purposes only and does not confirm the underlying insurance policy. For contractors, it offers clients peace of mind, demonstrating that you’re prepared for unexpected incidents that might occur during a project. For example, general liability insurance covers bodily injury or property damage caused to third parties.

When Do Contractors Need a COI?

Contractors may need to provide a COI in various scenarios to demonstrate proof of adequate insurance coverage.

Here are some everyday situations where a COI is required:

Signing a Contract: Most clients won’t allow work to begin until you provide a COI that verifies you have the required insurance coverage. This ensures that both parties are protected against potential liabilities, such as property damage, bodily injuries, or other unforeseen incidents that could occur during the project. A COI serves as a reassurance that your business can cover potential risks, which builds trust and confidence in the working relationship.

Commercial Leases: Property managers and landlords often require tenants to provide a COI as part of their lease agreement. This confirms that you have the necessary insurance to protect their property and cover any damages or liabilities associated with your tenancy. For contractors leasing office or storage space, a COI ensures compliance with lease terms and protects you from disputes related to liability issues.

General Contracting Work: In the construction industry, general contractors frequently request COIs from their subcontractors before allowing them to work on a project. This ensures that all subcontractors have appropriate coverage, such as general liability, workers’ compensation, or commercial auto insurance. By requiring COIs, general contractors mitigate risks and ensure that every team member on-site is protected, minimizing the potential for legal or financial disputes.

Permits and Licensing: Some local governments or regulatory bodies require a COI before issuing permits or licenses for certain types of work, especially in construction. Providing a COI demonstrates compliance with legal requirements and helps avoid delays in obtaining necessary approvals.

Partnerships and Joint Ventures: When collaborating with other businesses or forming joint ventures, you may need to provide a COI to show that your insurance coverage aligns with the partnership’s requirements. This step ensures that all parties involved are adequately protected from potential liabilities.

Vendor Agreements: If you’re supplying goods or services as a vendor, some clients may request a COI to confirm your insurance coverage. This is especially common when delivering services that involve potential risks, such as equipment rentals, event setups, or maintenance work.

How to Get a Certificate of Insurance

If you’re looking for COI construction requirements or trying to figure out how to get a COI, the process is typically straightforward—especially if you already have an active insurance policy.

Follow these simple steps:

- Contact your insurance provider or agent: Request a COI for the specific project or client. Provide all necessary details, including any specific contract requirements, such as additional insureds or coverage limits.

- Review policy details: Ensure your current policy meets client requirements. Work with your provider to adjust coverage if changes are needed (e.g., higher limits or additional endorsements).

- Receive the COI: Once your agent issues the certificate, you can send it directly to your client. Some insurance companies allow you to download COIs instantly from their customer portal.

What Information is Included in a COI?

A COI typically includes:

- Insurance company and policyholder details

- Type of coverage (e.g., general liability, workers’ compensation)

- Policy number and effective dates

- Policy limits and endorsements

- Certificate holder (e.g., client’s name)

- Additional insureds (if applicable)

Cost and Time to Obtain a COI

A COI is usually free if you have an active insurance policy. The time to receive a COI can vary but generally ranges from a few minutes to 48 hours, depending on your provider’s speed and whether your policy requires adjustments.

Key Tips for Smooth COI Management

- Plan ahead: Request a COI as soon as you know it’s required, especially if endorsements need to be added.

- Double-check details: Ensure the COI accurately reflects all contractual requirements, including additional insureds and coverage limits.

- Communicate clearly: Provide your insurance agent with all necessary contract details upfront to avoid delays.

Why Managing COIs Matters

Efficient COI management ensures compliance and avoids project delays. Incorrect or outdated documentation can lead to complications, including withheld payments or missed opportunities. By proactively managing COIs, you protect your business and build trust with clients.

Streamlining COI Management with Technology

Tools like Billy simplify COI management by automating document collection, tracking, and verification. Our platform helps contractors reduce manual administrative tasks, ensuring that COIs remain current and compliant with project requirements.

Whether you’re searching for where to get a COI or need help managing COI construction needs, tools like Billy can make the process seamless and efficient.

By streamlining the COI process and maintaining compliance, contractors can focus on what they do best—building and managing projects—without getting bogged down by paperwork. With the right tools and strategies in place, managing insurance requirements becomes one less thing to worry about.

Want to learn how Billy can help your business stay compliant and reduce COI-related headaches? Schedule a personalized demo and start your free trial today!

Frequently Asked Questions

How fast can you get a COI?

The time to receive a Certificate of Insurance (COI) in the construction industry can vary depending on your insurance provider. Typically, it can take from a few minutes to 48 hours, depending on whether any adjustments to your coverage are needed.

Who creates a Certificate of Insurance?

A Certificate of Insurance (COI) is usually created by your insurance provider or agent. It summarizes the details of your insurance coverage specific to your industry needs and is issued upon request.

Who signs a certificate of insurance?

An authorized representative of the insurance company signs a certificate of insurance (COI). This person is usually the insurance agent or broker who created the certificate. However, not all insurance agents or brokers are authorized to sign a COI.