Managing certificates of insurance (COIs) is a time-consuming yet crucial task for subcontractors. With multiple projects, clients, and contractors to manage, ensuring proper compliance and documentation can feel overwhelming. Adopting efficient processes and innovative tools can save you time and money, allowing you to focus on what matters most: delivering quality work.

Why COIs Matter for Subcontractors

As a subcontractor, COIs are your proof of insurance coverage and compliance with contract requirements. General contractors and project owners require these certificates to mitigate risks and protect all parties involved in the project. Without proper COI management, you risk project delays, disputes, or even losing out on lucrative opportunities.

Key Reasons to Keep Your COIs in Order:

- Compliance with Contractual Obligations: Most contracts stipulate specific insurance requirements. Providing up-to-date COIs ensures you meet these conditions.

- Building Trust with Contractors: Efficient COI management demonstrates your professionalism and reliability.

- Minimizing Risk of Legal and Financial Penalties: Missing or outdated COIs can lead to fines, lawsuits, or liability issues.

- Streamlining Payment Processes: General contractors are more likely to approve invoices quickly when all insurance documentation is in place.

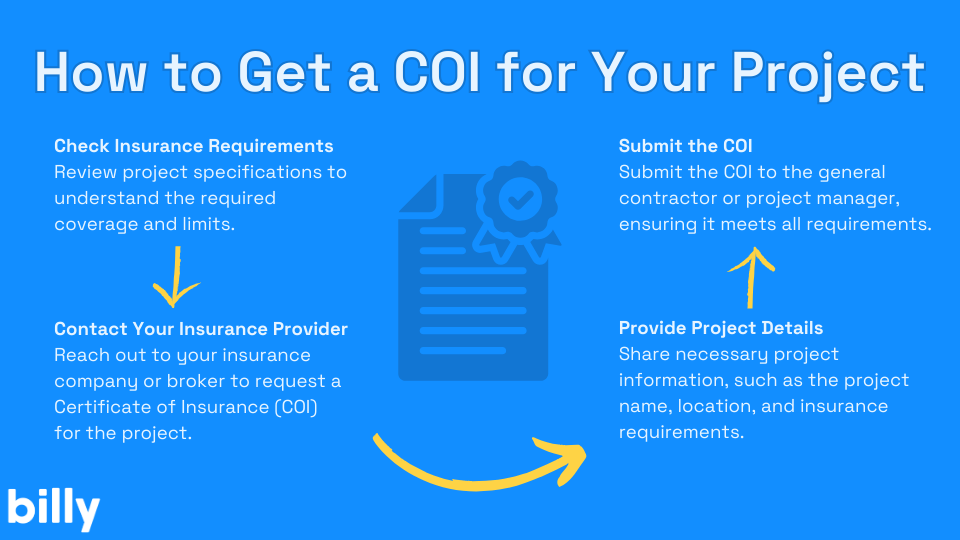

If you’ve ever wondered where to get a COI or needed a guide tailored for subcontractors, understanding these key reasons can help clarify its importance in daily operations.

Common Challenges Subcontractors Face

Despite their importance, COI management comes with unique challenges for subcontractors:

Time-Intensive Tracking

With multiple projects and clients, tracking COIs can consume valuable hours that could be spent on core business activities.

Lack of Centralized Organization

Without a proper system, COIs often get lost in emails or physical files, leading to inefficiencies and missed deadlines.

Keeping COIs Updated

Insurance policies expire, and gaps in coverage can result in non-compliance, risking project delays or penalties.

Navigating Complex Requirements

Each contractor or project may have different insurance standards, making it challenging to track and fulfill them accurately. Knowing how to get a COI for different projects ensures you stay ahead of these challenges.

The Risks of Poor COI Management

Ignoring proper COI management can have serious consequences. Subcontractors who fail to keep their insurance documentation in order may experience significant project delays, especially if missing or incomplete COIs cause a project to halt. Such delays can damage relationships with contractors and harm your reputation in the industry.

Financial Liabilities

If an accident or claim arises on a job site and your coverage is found to be inadequate, you could face out-of-pocket expenses that hurt your bottom line.

Reputation Damage

Contractors may hesitate to work with subcontractors who consistently struggle to provide proper documentation. Demonstrating that you understand contractors’ proof of insurance requirements can build your reputation as a reliable partner and open doors to future opportunities.

The Solution: Streamlining COI Management

Addressing these challenges begins with adopting a more efficient approach to COI management. By embracing digital tools, standardizing processes, fostering collaboration, and conducting regular audits, subcontractors can save time, reduce risk, and improve their overall workflow.

Embrace Digital Tools

Digital tools offer a game-changing solution for COI management. Platforms designed specifically for this purpose allow subcontractors to store all COIs in a centralized database, ensuring easy access when needed. Automated reminders help you stay ahead of expiration dates, preventing coverage lapses that could result in non-compliance.

Real-time tracking capabilities also make it easier to monitor compliance across multiple projects and contractors. When searching for ‘where to get a COI’ or looking for digital platforms, prioritize tools that simplify your processes and improve organization.

Standardize Your Processes

Standardizing your processes is another key strategy. Establishing consistent workflows for requesting, receiving, and storing COIs reduces confusion and minimizes errors.

For example, creating a detailed checklist that includes all necessary policy details—such as dates, coverage limits, and additional insured endorsements—ensures nothing is overlooked. Clear communication with insurance providers is equally important, as it helps them understand your requirements and deadlines, facilitating a smoother process overall.

Collaborate Effectively with Contractors

Collaboration with general contractors and project managers also plays a crucial role in successful COI management.

Be proactive about:

- Clarifying Insurance Requirements: Open communication about specific insurance requirements and prompt delivery of documentation can prevent unnecessary delays.

- Providing Documentation Promptly: Deliver COIs as soon as possible to avoid delays.

- Requesting Feedback: Being proactive in seeking feedback on your COI submissions allows you to identify areas for improvement and build stronger relationships with your contracting partners.

Building a clear understanding of how to get a COI that meets all project requirements strengthens these professional relationships and ensures smooth operations.

Conduct Regular Audits

Regular audits are essential to maintaining the accuracy and completeness of your records. Periodic reviews help you identify missing or incomplete documentation, policies nearing expiration, and any discrepancies in coverage.

Scheduling quarterly audits or using software that automates this process can ensure that your records are always current and compliant.

The Benefits of Streamlined COI Management

Investing in better COI management processes provides subcontractors with tangible benefits:

Increased Efficiency

Efficient COI systems reduce administrative workload, freeing up time to focus on delivering quality work and growing your business.

Enhanced Compliance

Staying on top of insurance requirements reduces the risk of fines, lawsuits, or other penalties, providing peace of mind.

Improved Relationships

General contractors and project owners value subcontractors who are organized and proactive. Streamlined COI management builds trust and strengthens professional relationships.

Greater Business Growth

By reducing the time spent on paperwork, subcontractors can focus on bidding for new projects and improving their services, leading to long-term growth.

Whether you’re navigating how to obtain a COI for subcontractors or exploring tools for efficient documentation, improved processes can significantly enhance your operations.

Simplify COI Management and Focus on What You Do Best

Managing COIs is a critical task for subcontractors, but it doesn’t have to be a burden.

By adopting streamlined processes and leveraging tools like Billy to handle insurance policy management and COI requests, subcontractors can simplify their workflows, reduce risks, and unlock new opportunities.

With the right strategies in place, you can spend less time worrying about paperwork and more time focusing on what you do best: delivering quality work and growing your business. Whether you’re asking ‘how do I get a COI’ or looking to improve your compliance, taking control of COI management today can set the stage for lasting success.

Frequently Asked Questions

Can I create my own certificate of insurance?

No, certificates of insurance (COIs) must be issued by your insurance provider or broker. They verify your coverage and meet contractual requirements. Creating one yourself could lead to non-compliance or legal issues.

Do all vendors need a certificate of insurance?

Yes, most contractors require vendors to provide a COI to ensure proper coverage. It’s essential for managing risk and protecting all parties involved in the project.

Who requires a COI?

COIs are typically required by general contractors, project owners, or clients. They ensure that subcontractors, vendors, and suppliers meet the necessary insurance requirements for the job.