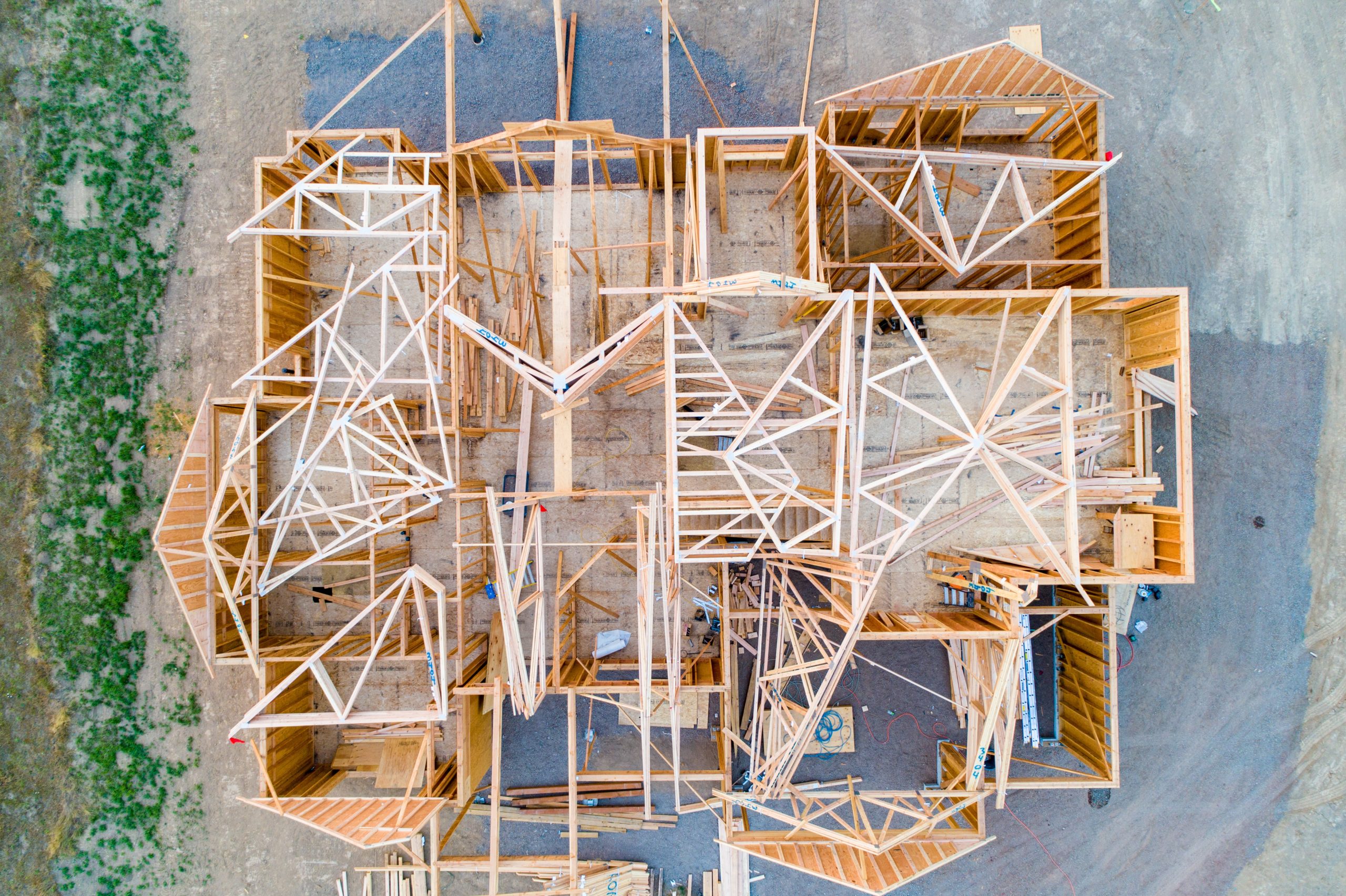

Builder’s risk insurance covers destruction or damage to a construction site and project such as a new build or a renovation to an existing home. You will need builders’ risk insurance if you own the property and your contractor doesn’t have proper coverage.

Who needs builders’ risk insurance?

Anyone with a financial interest in the construction project. These include the lender, project owner, general contractors, subcontractors, and architects.

What is the difference between Builders Risk Insurance & Homeowners Insurance?

Homeowners’ insurance is for completed homes, while builders’ risk insurance is for homes still under construction or renovation. Homeowners insurance protects your home and its contents, provides coverage for additional living expenses, and liability protection in case someone is injured on your property, or your property sustains a loss and you need to make an insurance claim.

Builders’ risk insurance covers the property while it is under construction but does not cover persons injured on your property during construction or renovation. Your contractor must provide a General Liability policy that adds you as the additional insured on a certificate of insurance.

How much is Builders Risk Insurance for Homeowners?

The cost of builders’ risk insurance is between 1% – 4% of the total completed value of the project. The total includes the cost of all the labor and materials installed on the project.

Who pays for builders’ risk insurance?

This is a decision made between the homeowner and the contractor. If the contractor pays for the builder’s risk insurance policy, the cost will get passed on to the homeowner in the construction bid.

Where can I buy a builders risk policy?

You can request a quote from a licensed insurance agent here. Billy is a licensed insurance agency in all 50 states. Click to get a quote.